2024 ends with Q4 value sales virtually flat year on year, and volume down -5.0%

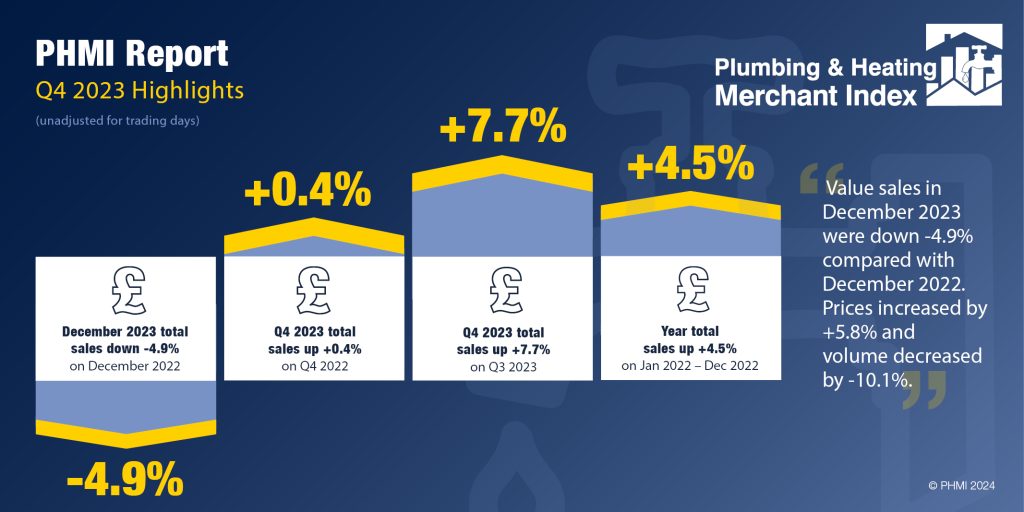

The latest Plumbing & Heating Merchant Index (PHMI) report, published in February, shows Q4 2023 total value sales through specialist Plumbing & Heating merchants were flat (+0.4%), compared with Q4 2022, with falling volumes (-5.0%) and higher prices (+5.7%). With one more trading day in Q4 2023, like-for-like sales were -1.3% down.

Total value sales were +7.7% higher in Q4 2023 compared to Q3 2023. This was driven by price increases (+10.1%) as volumes fell -2.2%. With four less trading days in Q4, like-for-like sales were up +14.8%.

Total value sales through specialist Plumbing & Heating merchants for the year (January to December 2023) increased +4.5% compared to the previous 12 months. But volumes were down -2.4% and prices climbed +7.1%. There were two additional trading days in 2023, so like-for-like sales were +3.6%.

December 2023 value sales were down -4.9% on the same month a year ago. Volumes decreased by -10.1% and prices increased +5.8%. There was no difference in trading days.

Month-on-month, December value sales were down -30.0% on November. Volume sales fell -35.5% and prices were up +8.5%. With six less trading days in December compared to November, like-for-like sales were -3.8% lower. However, these figures are broadly in line with seasonal trading patterns for December.

The PHMI Index for December 2023 was 84.3. With five less trading days compared to the base period, December’s like-for-like sales index was 108.9.

Mike Rigby, CEO of MRA Research, which produces the report comments: “Compared to the previous year, Plumbing & Heating Merchants’ value sales rose +4.5% in 2023, but volume was down -2.4%. Prices increased 7.1%.

“Despite the announcement of the UK economy entering recession, technical or not, at the end of 2023, consumer confidence continued to improve, and has improved dramatically from a low of -38 in February 2023 to a much improved -19 in January, the best it’s been in two years. It fell back two points in February to -21. But ‘optimism for our personal financial situation for the next 12 months’, one of the five component measures of GfK’s Consumer Confidence Index, did not lose ground (registering again at zero, having been as low as -18 last February). This is an important metric because confident householders are more likely to spend, even in a cost of living crisis.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research. There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.