May value sales down -1.9% but volumes are on the up (+5.8%)

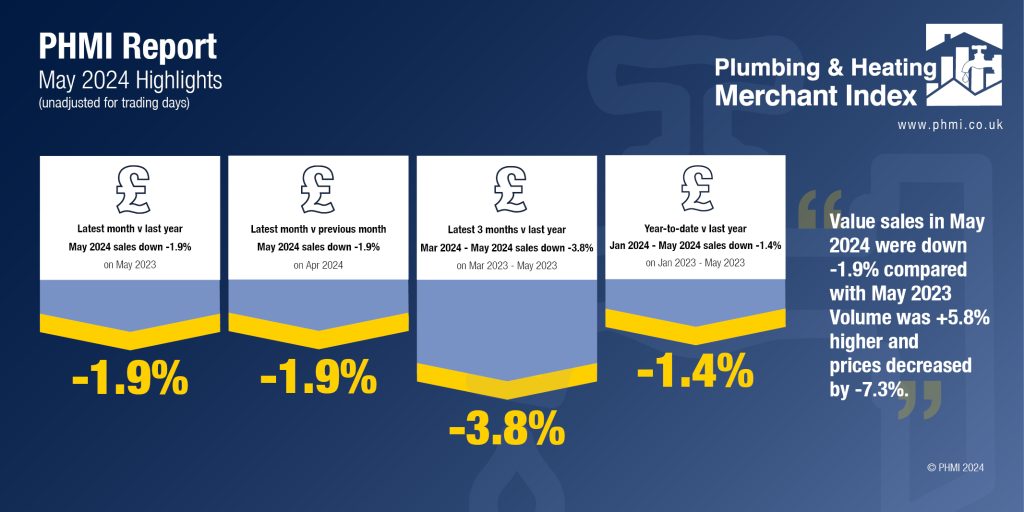

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for May 2024 through specialist plumbing and heating merchants were down -1.9% compared to May 2023. However, year-on-year volumes increased +5.8% while prices decreased -7.3%.

With one extra trading day in May 2024, like-for-like sales (taking trading day differences into account), were -6.6% lower than the same month a year before.

Compared to April, May value sales also slipped -1.9%. Volume sales were flat (-0.2%) and prices decreased by -1.8%. There was no difference in trading days.

Total value sales in the three months March to May 2024 were down -3.8% compared to the same period a year ago. There was a nominal increase in volumes (+0.8%) but prices were down -4.6%. With one more trading day in the most recent three-month period, like-for-like sales were -5.4% lower.

Compared to the previous three-month period (December 2023 to February 2024), value sales in the three months March to May 2024 were -2.0% down. Volume sales increased +11.5%, but prices decreased -12.1%. With three more trading days in the most recent period, like-for-like sales were -6.8% lower.

Plumbing & Heating merchants’ value sales in the rolling 12-month period from June 2023 to May 2024 were up slightly (+0.9%) on the previous 12-month period. However, volume sales were down -1.9%, with prices up +2.8%. With six more trading days this year, like-for-like value sales were down -1.5%.

May’s PHMI index was 96.1 with no difference in trading days compared to the base period.

Mike Rigby, CEO of MRA Research, which produces the report says: “The latest ONS data reports monthly construction output growing +1.9% overall in May, helped by a +2.8% increase in new housing work and a +0.8% lift in repair and maintenance work. Reasons to be more cheerful perhaps. But this increase has yet to roll through specialist plumbing and heating merchants.

“Consumer confidence has continued to strengthen, with the GfK Consumer Confidence Index registering a three-point increase to -14 in June, the highest level it’s been since November 2021. Consumers are more optimistic about the economy both now and in the next 12 months, and upbeat about their intentions to make major purchases. Is this the combined effect of the prospect of change and its realisation in a new Labour Government that’s determined to remove the barriers to growth in the economy? Hopefully so, as if Labour can come good on its pledge to build 1.5 million houses over the next five years and unblock the economy, it will be a welcome boost to plumbing and heating merchants, trades, and homeowners.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.