Weaker expectations trim confidence in the market

The Pulse, MRA Research’s temperature-check on builders’ merchants’ confidence and prospects, is now in its sixth month. Starting in May 2019, we talk to a representative sample of merchants every month to track expectations. While news headlines change on a daily basis, the consistency of monthly tracking reveals some underlying trends for today’s market and economic climate.

With the Brexit deadline delayed again and an election called for December, the prolonged uncertainty is eroding confidence in the market and affecting merchants. In this latest survey of The Pulse, merchants’ sales expectations and confidence weakened in October compared to the previous month and the same period last year. But, while merchants appear more cautious for the short-term, they are still positive about the medium to longer-term.

Sales expectations

Merchants’ month-on-month sales expectations eased from a strongly positive net +49% of merchants in the September report expecting higher sales, to a net +37% forecasting an increase in October compared with September. See Chart 1. Expectations for October were positive across size of branch, region and type of merchant, although they were strongest in large branches (net +53%), merchants in the South and Scotland (+44%) and among nationals (+53%).

Merchants’ month-on-month sales expectations eased from a strongly positive net +49% of merchants in the September report expecting higher sales, to a net +37% forecasting an increase in October compared with September. See Chart 1. Expectations for October were positive across size of branch, region and type of merchant, although they were strongest in large branches (net +53%), merchants in the South and Scotland (+44%) and among nationals (+53%).

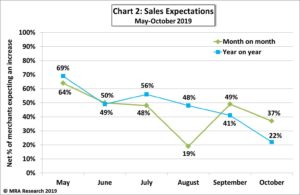

The slide in sales expectations is more striking year-on-year, with merchants’ outlook weakening since May. A net +22% of merchants expected higher sales in October compared with the same month last year. This compares to a net +69% in May and a net +41% in September. See Chart 2.

Mid-sized and large branches are most bullish year-on-year, a net +34% and +27% respectively forecasting growth, compared to a net +10% of small outlets. Merchants in Scotland are most positive (net +50%). This compares with a net +23% in the South, +20% in the North and a net +7% of stockists in the Midlands expecting a stronger October.

Mid-sized and large branches are most bullish year-on-year, a net +34% and +27% respectively forecasting growth, compared to a net +10% of small outlets. Merchants in Scotland are most positive (net +50%). This compares with a net +23% in the South, +20% in the North and a net +7% of stockists in the Midlands expecting a stronger October.

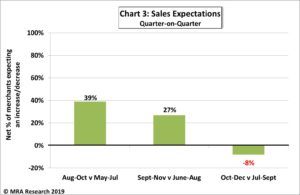

Looking three months ahead, October-December, a net -8% of merchants expect sales to ease compared with July-September. See Chart 3. Mid-sized merchant branches are the most cautious (net -27%). Regionally, while merchants in the North (-25%) and Midlands (-11%) predict lower sales in the period, those in the South and Scotland, on balance, expect no change.

A new question tracking merchants’ outlook further ahead was added this month. A net +10% of merchants forecast better sales over the next six months (October 2019 to March 2020) compared with the previous six months (April to September 2019). Small outlets (net +28%) and merchants in the Midlands (+26%) had the strongest expectations.

A new question tracking merchants’ outlook further ahead was added this month. A net +10% of merchants forecast better sales over the next six months (October 2019 to March 2020) compared with the previous six months (April to September 2019). Small outlets (net +28%) and merchants in the Midlands (+26%) had the strongest expectations.

Market confidence

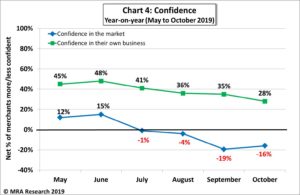

Merchants’ confidence in the market weakened in October with a net -13% less confident now than in the previous month. Small outlets (net -20%) and merchants in the Midlands (-21%) were particularly affected.

Year-on-year it’s a similar picture, with a net -16% of merchants less confident in October than the same month last year. See Chart 4. Independents (net -24%) and regional merchants (net -21%) are significantly less confident than nationals (net -6%). Those who are LESS confident mention the uncertainty around Brexit and politics particularly.

Merchants who were MORE confident, mostly mentioned local conditions. A few even attributed their confidence to the easing of uncertainty around Brexit.

Business confidence

Merchants’ confidence in their own business has also declined, but it is significantly stronger than their confidence in the market. A net +38% of merchants were more confident in October than in September. Compared with October last year, a net +28% of merchants were more confident. See Chart 4.

Merchants’ confidence in their own business has also declined, but it is significantly stronger than their confidence in the market. A net +38% of merchants were more confident in October than in September. Compared with October last year, a net +28% of merchants were more confident. See Chart 4.

The Pulse is a monthly trends survey that tracks builders’ merchants’ confidence and prospects over time and is produced by MRA Research, the market research division of MRA Marketing. Find out more here and look out for the next report in the December edition of PBM!

You can now subscribe to receive The Pulse directly in your inbox each month. Sign up to The Pulse.