Builders Merchants’ sales up year-on-year

The latest figures from the Builders Merchants Building Index (BMBI) reveal that year-on-year sales through UK builders’ merchants are on an upward trajectory, as the industry continues to meet sustained high demand for building products.

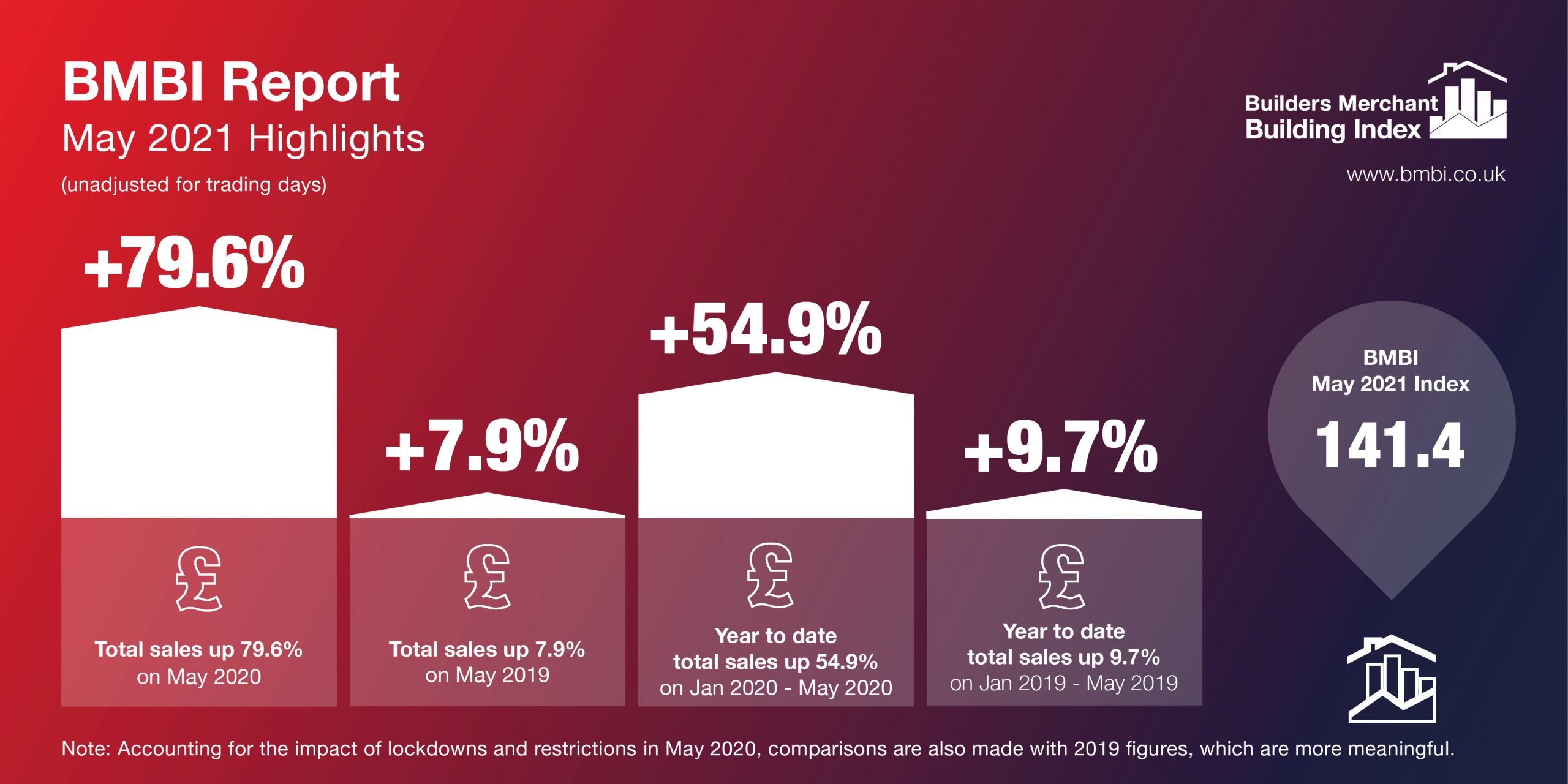

Total Merchants value sales were up 79.6% in May 2021 compared to May 2020 with no difference in trading days. Comparisons with May 2020 show a turnaround in fortunes for many categories. Tools performed the best (+180%) after being the weakest category in May 2020, and six other categories more than doubled year-on-year sales, including Kitchens & Bathrooms (+154.9%), Plumbing Heating & Electrical (+118.1%) and Timber & Joinery Products (+115.1%).

The country was still in full lockdown in May last year, so significant increases are expected. However, total sales were also up compared to May 2019 (+7.9%), with two less trading days, and average sales a day were 19.3% higher over the same period.

While May 2021 sales are much improved on May 2020, some categories are still waiting to hit their pre-pandemic levels. Comparisons with May 2019 sales show that just three of the 12 categories sold more, led by Timber & Joinery Products (+28.1%) and Landscaping (+26.5%).

Month-on-month figures indicate that May sales failed to reach the record-breaking heights seen in March and April (-6.1% on April, with one less trading day). All categories sold less, but some did better than merchants generally including Kitchens & Bathrooms (-1.8%), a positive sign that inside trades are getting back on their feet after being hampered by the winter lockdown.

May’s BMBI index was 141.4, with two less trading days, demonstrating builders’ merchants’ continuing sales growth. Nine of the 12 categories exceeded 100, with Landscaping (220.5) and Timber & Joinery Products (173.2) both out-performing merchants overall.

Mike Rigby, CEO of MRA Research who produce this report, said: “Year-on-year sales are looking strong and they will surely continue to gather momentum as the remaining restrictions are lifted and more inside trades get back to work.

“To ensure we continue on a growth trajectory, balancing supply and demand will be key. Supplier lead times are the highest they’ve been for almost 25 years is putting pressure on pricing and customer service. Forward planning and regular communication with customer and suppliers is a must if merchants and the industry as a whole are to ride out the storm.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK Retail & Technology UK adds:

“While sales in May haven’t reached those same dizzy heights as March and April, there is plenty to be positive about. Construction output has picked up from earlier in the year, driven by housebuilding and a good pipeline of public infrastructure projects, and categories which had been struggling like Kitchens & Bathrooms.

“Material shortages remain a concern though – particularly steel, timber, cement and roof tiles supplies – and with this forecast to continue until the end of the year, merchants may have a few more headaches to come as we head into the summer months.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

May’s BMBI report, published in July, is available to download at www.bmbi.co.uk.