2022 off to a good start as BMBI reports strong January sales

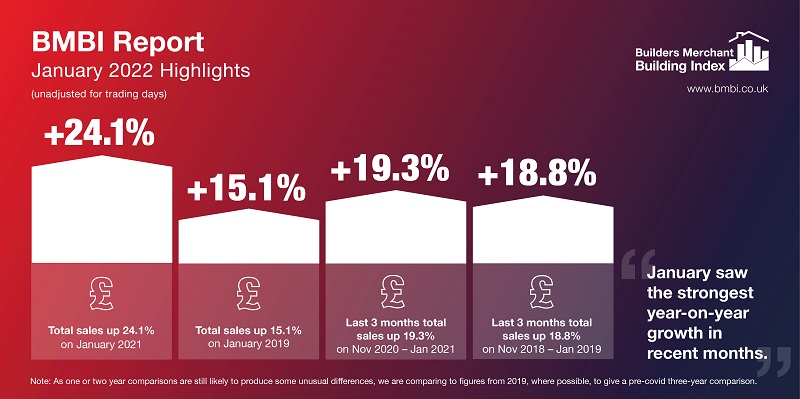

The latest Builders Merchant Building Index (BMBI) report reveals that builders’ merchants’ value sales in January 2022 were 24.1% up on the same month in 2021, the strongest year-on-year growth seen in recent months. However it has been primarily driven by price inflation (+15.1%) rather than volume growth (+7.8%).

All bar one category sold more than the same month in the previous year with Renewables & Water Saving (+35.8%), Timber & Joinery Products (+31.5%), Landscaping (+28.9%) and Kitchens & Bathrooms (+28.8%) outperforming the merchants generally. Seven categories grew more slowly including Heavy Building Materials (+21.4%), Plumbing Heating & Electrical (+18.1%) and Tools (+13.3%).

Compared to January 2019, a pre-pandemic year, total merchant value sales were 15.1% higher in January 2022, with two less trading days this year. Over the same period of comparison, prices increased at a faster rate (+19.8%), while volume sales were down 3.9%.

Ten of the 12 categories sold more with Landscaping (+32.5%) and Timber & Joinery Products (+31.9%) again leading the charge. Kitchens & Bathrooms (+11.4%) and Heavy Building Materials (+9.8%) also performed well, while Decorating (-1.5%) and Tools (-3.2%) sold less. Total like-for-like value sales were 26.6% higher than January 2019.

Month-on-month total merchant sales were 28.7% up in January 2022 compared to December 2021, helped by three more trading days in January. In the main categories, Timber & Joinery Products (+32.7%) did best, followed by Ironmongery (+30.7%), Tools (+30.6%) and Heavy Building Materials (+30.1%). Like-for-like sales were up 9.4%.

Mike Rigby, CEO of MRA Research who produce this report, said: “2022 is off to a flying start, with solid performances recorded across almost every category. However, we are seeing more evidence to support the industry belief that the sales boom we saw in 2020 and 2021 is slowing down, as volume sales give way to price inflation.

“What impact these higher prices will have on builders’ merchant sales this year remains to be seen, but with households now facing the highest levels of inflation for 30 years, it may be the end of the Repair, Maintenance, and Improvement (RMI) boom which gave the industry such a lift during Covid.”

Emile can der Ryst, Senior Client Insight Manager – Trade at GfK Retail & Technology UK adds: “January has seen a continuation of the recent growth trend, but even in January there were already expectations that this would slow down going forward. February will now be even more uncertain due to the Russian invasion of Ukraine, adding further instability to pricing indicators.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

January’s BMBI report, published in March, is available to download at www.bmbi.co.uk.