PHMI Q2 value sales up +2.7% year-on-year, but volume is down -5.3%

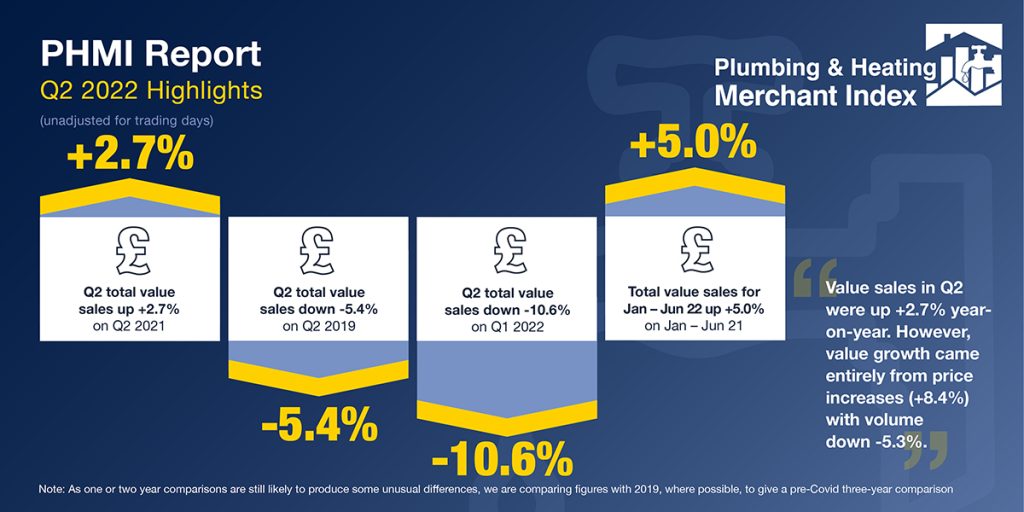

The latest Plumbing & Heating Merchant Index (PHMI) report, published in August, shows total value sales through specialist Plumbing & Heating merchants were up +2.7% in Q2 2022 compared to the same period in 2021.

However price inflation (+8.4%) not volume sales (-5.3%) is driving growth. With one less trading day this year, like-for-like sales were +4.4% up.

When compared to the same three-month period (April to June) in 2019, a pre-pandemic year, Q2 2022 value sales were down -5.4%. With one less trading day this year, like-for-like sales were -3.8% lower.

Quarter-on-quarter, Q2 2022 sales lagged -10.6% behind Q1 2022. Both volume sales (-8.9%) and prices (-1.8%) were down. With three less trading days in the most recent period, like-for-like sales were -6.1% lower.

Year-to-date value sales, in January to June 2022, were -3.5% lower than in the same six months of 2019. With one less trading day this year, like for like sales were down -2.7%.

Plumbing & Heating Merchants sales in the 12 months to June 2022 were -0.6% down on sales over the same period a year before (July 2020 to June 2021). Volume sales were -7.5% lower yet prices were up +7.4%. With two less trading days in the most recent period, like-for-like-sales were marginally higher (+0.2%).

June 2022 value sales were -4.0% below June 2021, but volume sales were down -11.1% with price inflation of 8.0%. With two less trading days this year, like-for-like sales were up +5.6%.

Compared to the same month three years ago, June 2022 sales were -8.7% lower than June 2019, with no difference in trading days.

Month-on-month, total value sales through specialist Plumbing & Heating merchants were down -13.6% in June compared to May. With one less trading day in the most recent period, like-for-like sales were down -9.2%.

The PHMI Index for June 2022 was 83.9. With one less trading day this year, the like-for-like index was 86.7.

Mike Rigby, CEO of MRA Research, which produces the report comments: “The Q2 figures show that value sales through specialist plumbing and heating merchants are largely holding up, but with volumes down again inflation is the sole driver of growth.

“The second quarter wasn’t helped by a particularly weak performance in June, where we saw a double digit fall in month-on-month value sales. This dip could reflect a return to a more normal summer where European and international travel is back on the cards, and tradespeople and their customers head off on holiday, putting a delay on new build and home improvement projects.

“Looking ahead, it’s difficult to predict what the second half holds for plumbing and heating merchants. Supply difficulties may have eased but, research shows that many tradespeople say they have lost some business because they haven’t been able to get hold of essential product. Inflation is ripping through the economy and consumer confidence is very weak, with many worried about their ability to pay future energy bills. All this will surely hit consumer spending and the mid to lower budget RMI market. But rising energy prices also make the best case for investing in energy saving and might encourage more homeowners with savings to invest in water and energy saving products as we move into the traditional ‘heating season’.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research. There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.

To download the latest report visit www.phmi.co.uk.