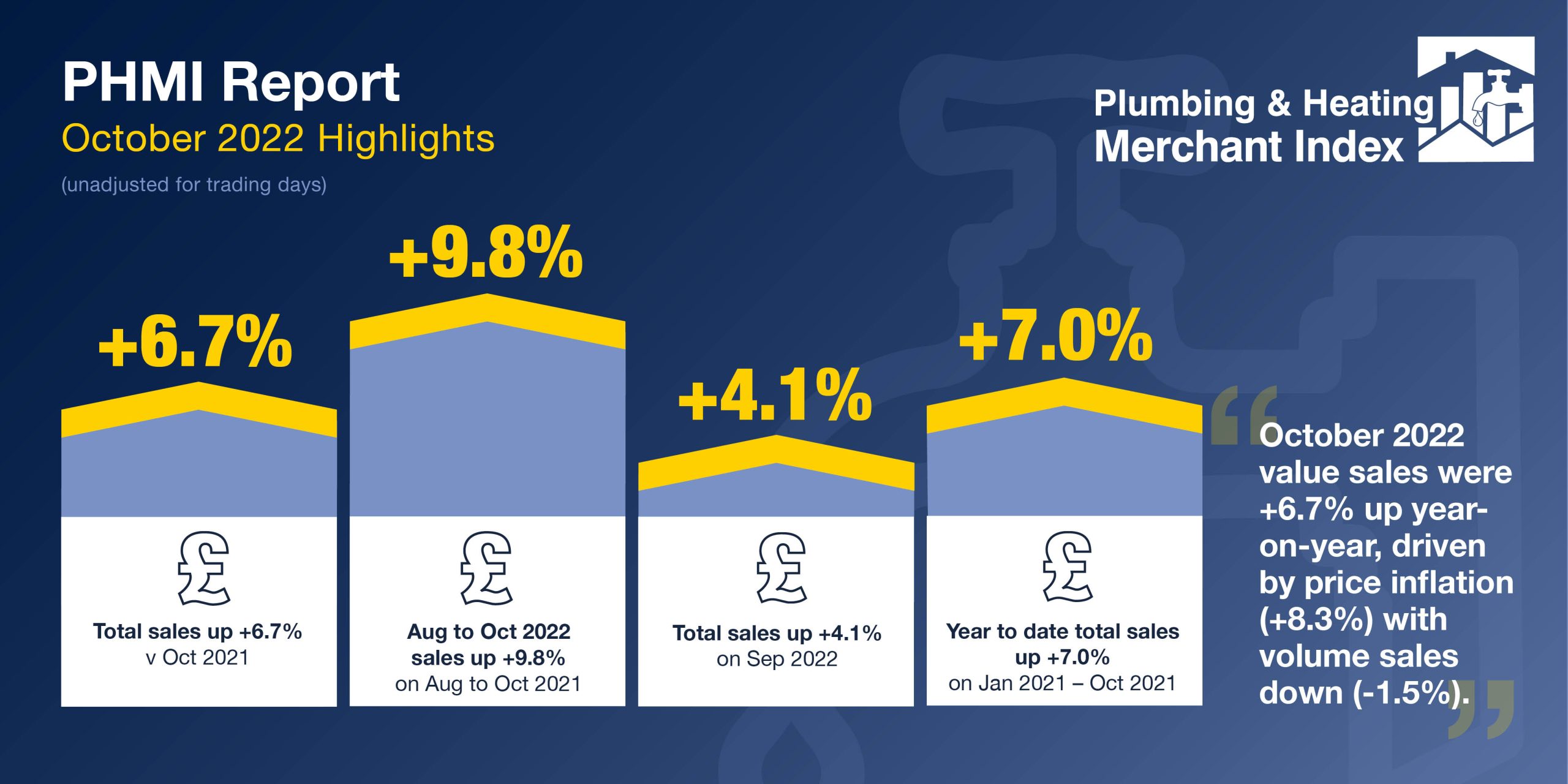

October Plumbing & Heating sales up +6.7% year-on-year

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for October 2022 through specialist plumbing and heating merchants were +6.7% higher than October 2021. With volumes easing -1.5%, year-on-year value sales growth was wholly driven by price inflation (+8.3%).

Month-on-month October value sales were +4.1 % up on September 2022. Volume sales were 2.6% higher and prices were also up (+1.4%). There was no difference in trading days.

Year to date value sales in the period January-October 2022 were +7.0% higher than the same period in 2021, but with volume sales down (-1.3%) +8.5% price inflation drove the increase. With two less trading days this year, like-for-like sales were +8.0% higher.

Plumbing & Heating merchants’ value sales in the last 12 months (November 2021 to October 2022) were +5.0% ahead of the previous twelve months, November 2020 to October 2021. However, volumes were lower (-3.3%) and prices were up +8.6%. With one less trading day in the latest period, like-for-like sales were +5.4% higher.

The PHMI index for October was 107.7, with no difference in trading days.

Mike Rigby, CEO of MRA Research, which produces the report comments: “October’s sales through specialist plumbing and heating merchants can be summed up as inflation driving growth while volumes continue to ease back. It reflects the impact of rising interest rates and high energy and material costs, and a cost of living and consumer confidence crisis on housing and home improvement markets.

“People say a week is a long time in politics. But a few months is now a long time in the economy. We can argue precise timing, but in the last few months, the prospects for the UK economy and construction have been on the wildest roller coaster. It’s swung all the way from manageable, long term positive to a sterling crisis, a gargantuan debt mountain, eye watering inflation, interest rates of 6%, the threat of mass business closures and mass unemployment, a housing market crash and the deepest of recessions, with no prospect of recovery in the next decade. And now it’s swinging all the way back to a recovery in sterling, interest rates topping out at 4.5%, forecast inflation rapidly easing, unemployment peaking at 4.9% (ONS stats) and a continuing problem of finding enough people to work, and a much milder recession. With all this happening in the middle of most companies’ budgeting periods, good luck with planning for 2023 and the next three years!”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report visit www.phmi.co.uk.