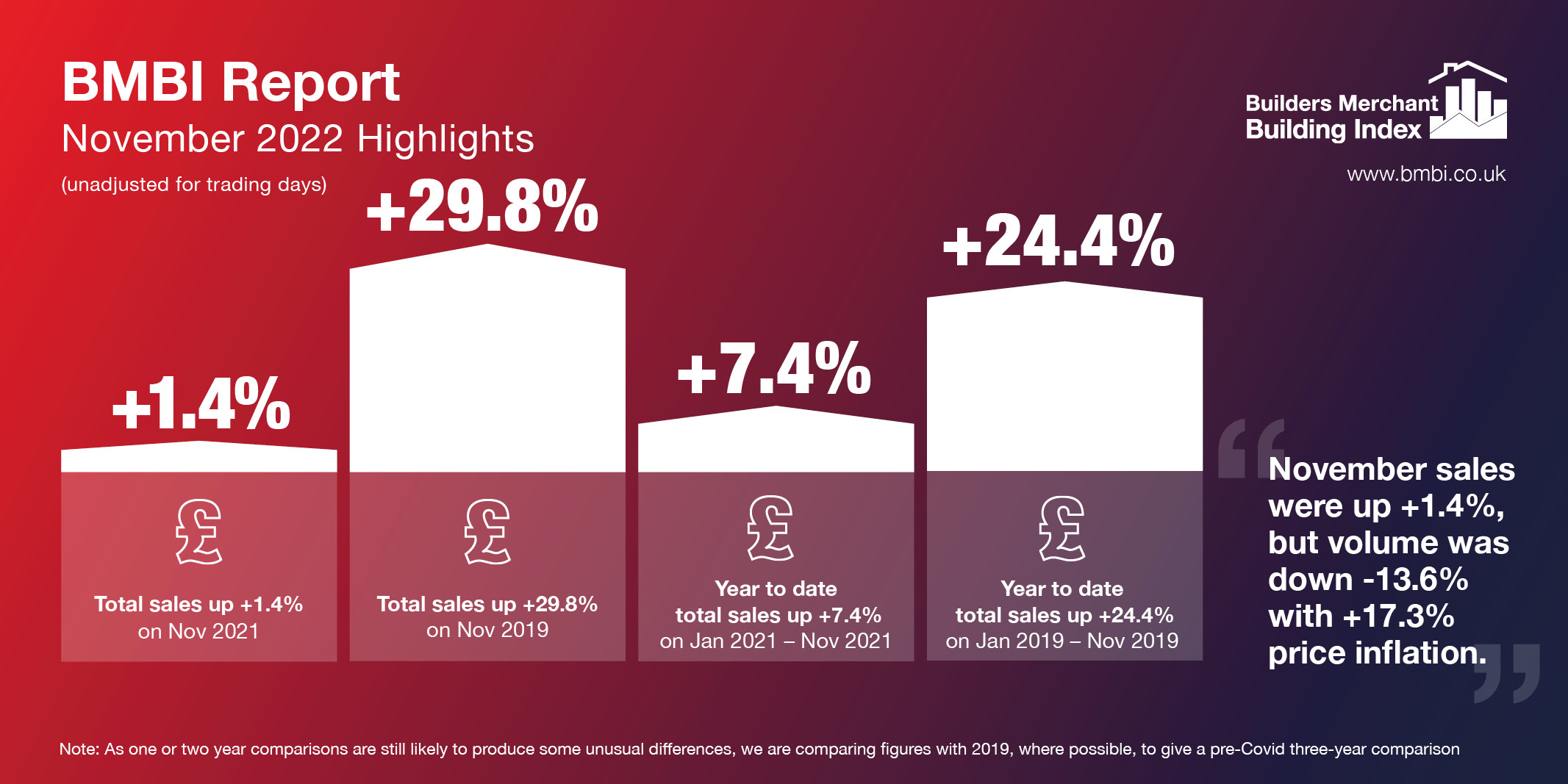

Merchants see nominal growth (+1.4%) in November, with falling volumes (-13.6%) and climbing prices (+17.3%)

The latest Builders Merchant Building Index (BMBI) report reveals that builders’ merchants’ value sales were up +1.4% in November 2022 compared to the same month in 2021. This was inflation-led growth as volume sales tumbled -13.6% while prices climbed +17.3%.

Nine of the twelve categories sold more in November compared to the previous year. Renewables & Water Saving (+37.9%) was the standout category, while Plumbing, Heating & Electrical (+17.5%), Workwear & Safetywear (+16.6%), Decorating (+15.3%) and Kitchens & Bathrooms (+14.8%) also did relatively well. Timber & Joinery Products (-12.0%) was the weakest category.

Compared to November 2019, a more normal pre-pandemic year, total merchant value sales were +29.8% higher. Volume sales fell -4.1% while prices were up +35.3%. With one extra trading day this year, like-for-like sales were +23.9% higher. All twelve categories sold more with four outperforming Merchants overall: Renewables & Water Saving (+58.1%), Landscaping (+39.7%), Timber & Joinery Products (+33.2%) and Heavy Building Materials (+31.1%).

Month-on-month, total merchant sales dropped slightly (-2.6%) in November compared to October. Prices went up (+4.9) but volume sales were lower (-7.2%). Despite the additional trading day in November, like-for-like sales were -7.0% down. Workwear & Safetywear (+11.2%) was the top performing category, followed by Kitchens & Bathrooms (+10.0%). Seasonal category Landscaping (-13.1%) was weakest.

Mike Rigby, CEO of MRA Research which produces this report, said: “November marked a period of relative stability for the UK after months of economic and political turmoil, but it’s too early to see the impact of Rishi Sunak’s and Jeremy Hunt’s steadier hands on construction and UK growth.

“There’s been a slew of better news in the New Year. Interest rates are expected to peak sooner and lower than earlier forecasts; high energy and material costs are now not expected to be so extreme. We may be over peak Truss-shock and the Autumn’s doom and gloom may have been overcooked, but there are plenty of challenges to overcome. It will take longer to repair the damage caused by the sharp rise in the cost of living, and a media focus on war with the unions will do nothing to lift the country’s well being. Weak consumer confidence will continue to impact the housing and home improvement markets. High mortgage rates are cutting demand for new homes and major builders have cut their build programmes. Older homeowners who are mortgage free or mortgage light, the Haves, continue to spend, but the Have Nots, many homeowners under 50 with smaller savings, whose outgoings have risen faster than their incomes, have delayed or cancelled their home improvements.

“Nevertheless, this could be the beginning of a return to normality which would be welcome news for consumers, tradespeople and merchants.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

November’s BMBI report, published in January, is available to download at www.bmbi.co.uk.