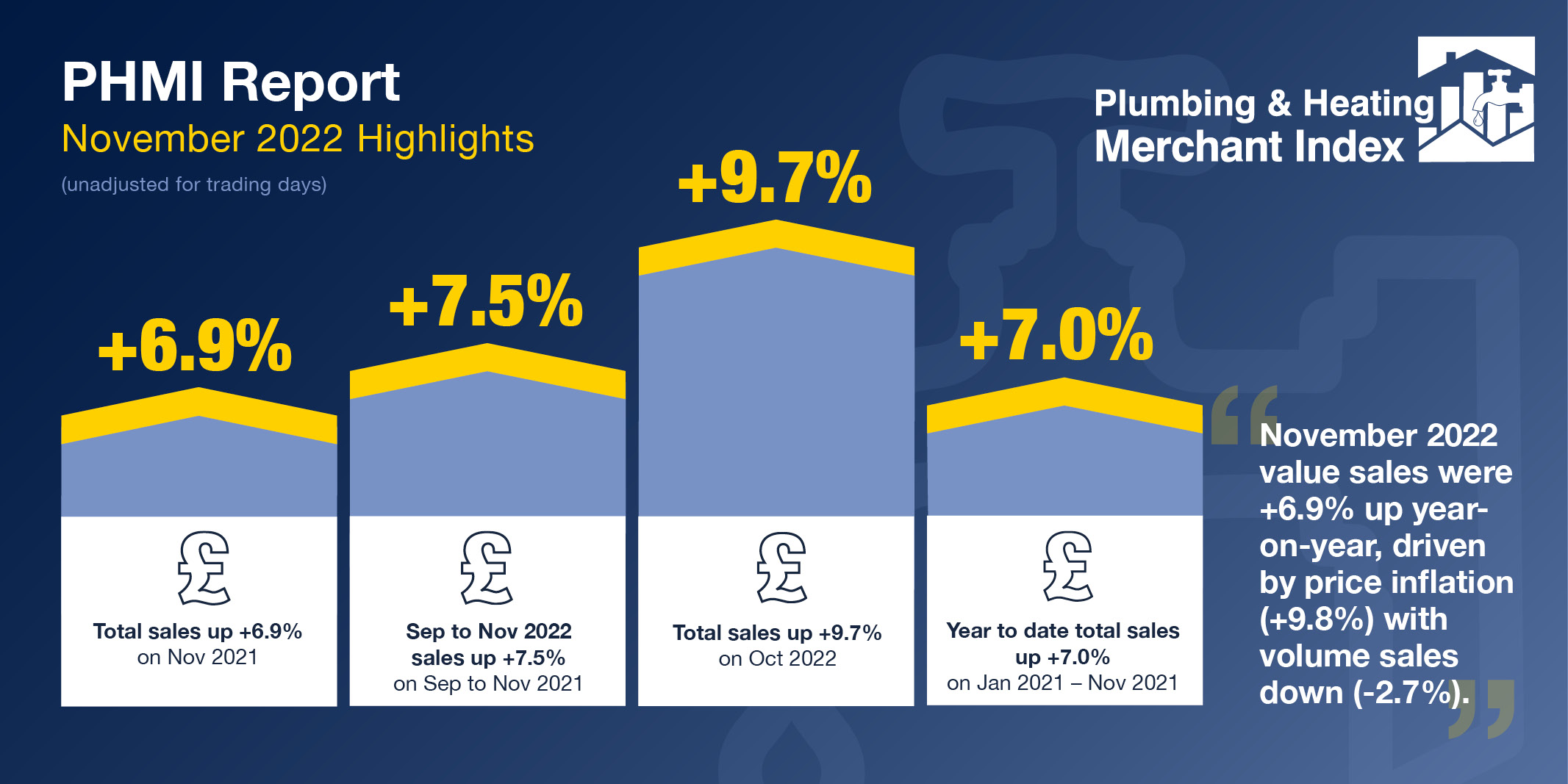

November Plumbing & Heating sales up +6.9% year-on-year but +9.8% price inflation behind growth

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for November 2022 through specialist plumbing and heating merchants were +6.9% higher than November 2021. Price inflation (+9.8%) was again the driving factor behind year-on-year growth with volumes falling -2.7%.

Month-on-month November value sales were +9.7% higher than October 2022. Volume sales saw positive growth (+6.8%) while prices were also up (+2.7%). With one extra trading day in November, like-for-like sales were +4.7% up.

Year to date value sales in the period January to November 2022 were +7.0% higher than the same period in 2021. However, with volume sales down (-1.5%) it was price inflation (+8.6%) driving the increase. With two less trading days this year, like-for-like sales were +7.9% higher.

Plumbing & Heating merchants’ value sales in the last 12 months (December 2021 to November 2022) were +5.8% ahead of the previous twelve months, December 2020 to November 2021. However, volumes were lower (-2.6%) and prices were up +8.6%. With two less trading days in the latest period, like-for-like sales were +6.7% higher.

The PHMI index for November was 118.1. With one additional day this month, the like-for-like sales index was 111.0.

Mike Rigby, CEO of MRA Research, which produces the report comments: “Year-on-year, the picture is the same as it has been for most of 2022, with sales through specialist plumbing and heating merchants driven primarily by inflation as prices are up but volumes are lower compared to 2021. It may be too soon to say but the PHMI month-on-month statistics show some green shoots of positivity as October and November both recorded volume growth and relatively lower inflation.

“In fact there’s been a slew of better news in the New Year. Interest rates are expected to peak sooner and lower than earlier forecasts, high energy and material costs are now not expected to be so extreme. But before we breathe a sigh of relief, there are plenty of challenges to overcome. It will take much longer to repair the damage caused by the sharp rise in the cost of living, and a steady diet of news of war with the unions over pay demands will do nothing to lift the country’s well being. Very weak consumer confidence will continue to impact the housing and home improvement markets. High mortgage rates are cutting demand for new homes and major builders have already cut their build programmes.

“Nevertheless, we may be over peak shock and the Autumn’s doom and gloom may have been overcooked. This could be the beginning of a return to normality which would be welcome news for consumers, tradespeople and merchants.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report visit www.phmi.co.uk.