Plumbing & Heating Merchant Q4 sales up +10.3% on Q422 with +11.0% inflation

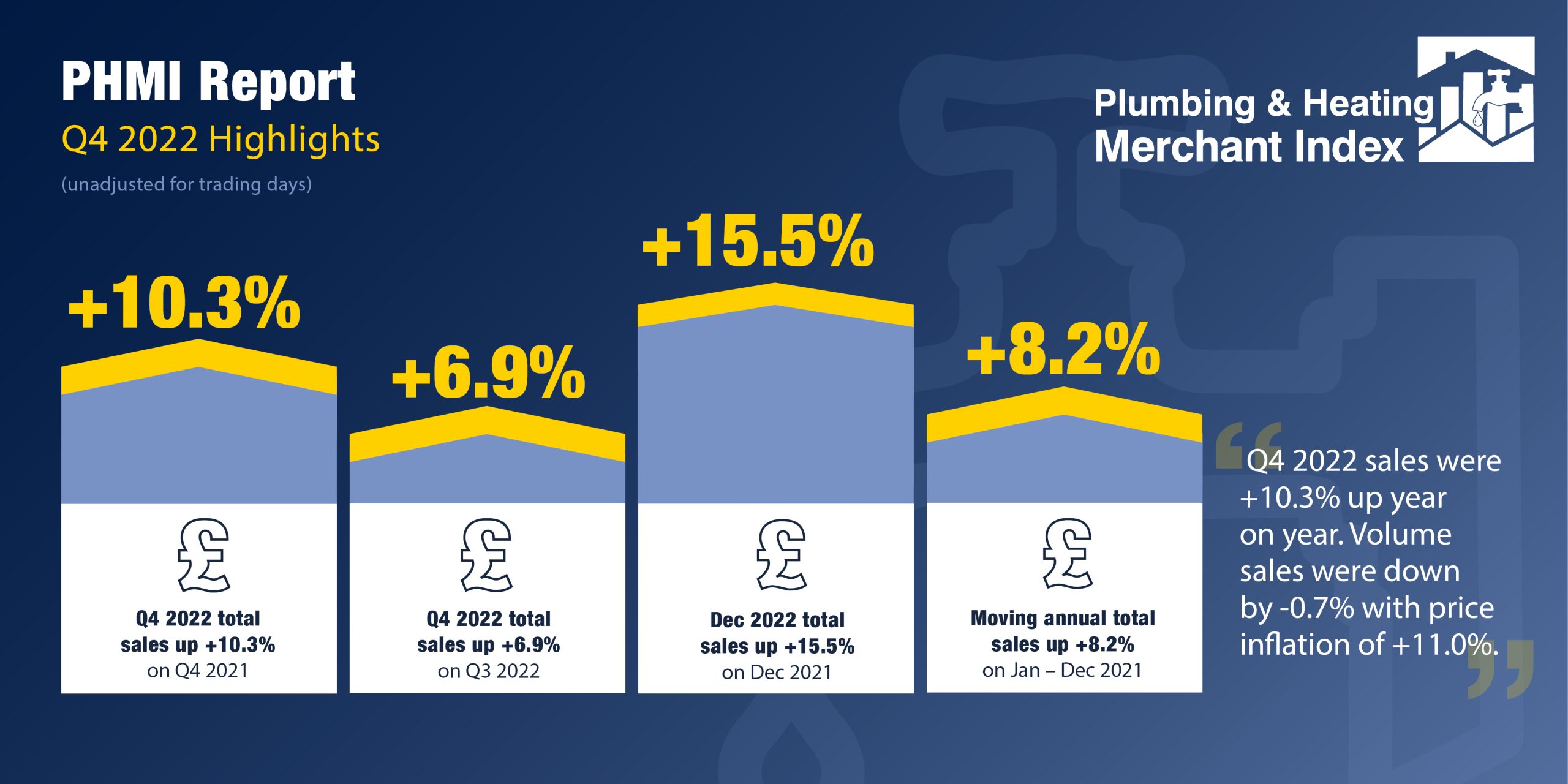

The latest Plumbing & Heating Merchant Index (PHMI) report, published in February, shows total value sales through specialist Plumbing & Heating merchants were up +10.3% in Q4 2022 compared to the same period in 2021.

Volume sales were -0.7% lower, while prices increased +11.0%. With one less trading day this year, like-for-like sales were +12.2% up.

Quarter-on-quarter, Q4 2022 sales were +6.9% higher than Q3 2022. Again, volume was down -2.6-% and prices were up +9.7%. With five less trading days in the most recent quarter, like-for-like sales were up +15.9%.

Total value sales through specialist Plumbing & Heating merchants for the 12 months January to December 2022 were +8.2% higher than the previous year. Volume sales were -1.0% down but prices were +9.3% up. With three less trading days in 2022, like-for-like sales were +9.5% higher.

December 2022 value sales were +15.5% above the same month a year ago, with volumes flat (+0.1%) and price inflation climbing +15.4%. With one less trading day this year, like-for-like sales were up +22.8%.

Month-on-month, December value sales were -25.1% lower than November, broadly in line with seasonal trends. Volume sales were down -31.1% while prices were up +8.8%. With six less trading days in December, like-for-like sales edged up +3.0%.

The PHMI Index for December 2022 was 88.4. With five less trading days in December compared to the base period, the like-for-like sales index was 114.2.

Mike Rigby, CEO of MRA Research, which produces the report comments: “A return to more seasonal trends, a particularly cold snap at the end of the year, high energy bills and low consumer confidence were all part of the mix contributing to a sharp drop in December sales. This muted Q4 results after better than expected October and November figures.

“Fluctuations in prices (going up) and volumes (going down) have been a theme throughout 2022 and these have been quite pronounced on a monthly and quarterly basis. But the overall picture for 2022 is less dramatic. Twenty twenty-two was still a year of growth, and the fall in volumes was marginal and nowhere near as bad as expected.

“As we move into 2023, hopefully there is an end in sight to the rolling ‘permacrisis’ which has affected consumers, housebuilders, trades and merchants since 2020. Supply problems have eased, and shipping costs from China and SE Asia have returned to normal. Inflation is starting to come down, and material costs are moderating, all of which will help to stimulate housebuilding and RMI markets again. Predictions have been so wide of the mark in the last three years, when no one expected any of the events influencing the extreme outcomes, that I hesitate to say that forecasts for doom in 2023 have been reined in. We could be starting the year in a much better position than previous years with the worst of times finally behind us.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research. There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.

To download the latest report visit www.phmi.co.uk.