Marginal value growth in year-on-year merchant sales in February

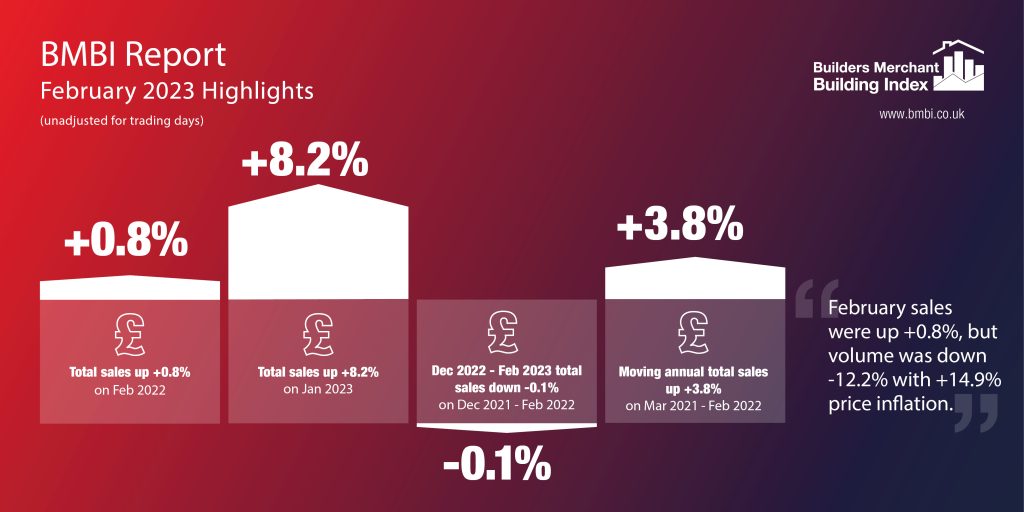

The latest Builders Merchant Building Index (BMBI) report reveals that builders’ merchants’ value sales were up +0.8% in February compared to the same month in 2022. This growth was driven exclusively by price inflation (+14.9%) as volume sales fell -12.2%. There was no difference in trading days.

Nine of the twelve categories sold more in February 2023 compared to February 2022. Renewables & Water Saving (+58.9%) was again the strongest performing category, while Decorating (+15.0%), Plumbing, Heating & Electrical (+13.3%), Workwear & Safetywear (+10.1%) and Ironmongery (+8.5%) also increased. Timber & Joinery Products (-13.9%), Landscaping (-12.5%) and Services (-2.1%) all sold less.

Month-on-month, total merchant sales were +8.2% higher in February 2023 than the previous month. Volume sales were +13.4% higher than January, while prices were down -4.6%. With one less trading day in February, like-for-like sales were up +13.6%. Month-on-month the strongest category was Landscaping (+27.6%), followed by Heavy Building Materials (+10.9%). Workwear and Safetywear (-6.5%) was the weakest performing category.

Total merchant sales in the twelve months from March 2022 to February 2023 were +3.8% up on the same period a year ago. Price inflation reached +16.6% while volumes were down -11.0%. With two less trading days in the most recent period, like-for-like sales were +4.7% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+35.0%) continuing to lead the field. Kitchens & Bathrooms (+16.1%), Plumbing, Heating & Electrical (+14.6%), Workwear & Safetywear (+13.8%), Decorating (+11.5%) and Heavy Building Materials (+9.5%) all did better than merchants overall. Landscaping (-5.1%) and Timber & Joinery Products (-7.6%) both sold less.

Mike Rigby, CEO of MRA Research which produces this report, said: “Twenty twenty-three has so far evaded recession, but it’s teetering between still rapidly rising prices and falling volumes.

“It’s a strange time with the economy caught between a Government pleased to welcome growth and a central bank keen to discourage it in its battle against inflation. Global financial markets wobbled after the collapse of Silicon Valley Bank and the hurried bundling of Credit Suisse into UBS. We can expect more bank failures, although few people are predicting a serious meltdown. GfK’s Consumer Confidence Index remains in strongly negative territory, but it has improved to -36 in March from the battering it took in September under the previous Prime Minister when it fell to -49. The Major Purchase Index, an important component of GfK’s overall Consumer Confidence Index improved +4 points to -33 in March but it’s still nine points down from the same month last year. This index is based on asking consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’

“Yet the improvement in private housing repair and maintenance surprised most commentators who were quick to write it off. It grew +5.0% in February according to the ONS, with the rebound attributed to various factors including an improvement in the weather, the return of the ‘improve, not move’ trend, and the ‘Haves’ carrying on regardless and continuing to spend on improving their homes. The Haves, generally older, mortgage-free homeowners account for the bulk of Britain’s savings and are better known as the Bank of Mum and Dad.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

February’s BMBI report, published in April, is available to download at www.bmbi.co.uk.