Plumbing & Heating Merchant Q2 sales rise +3.9%, as price inflation (+7.2%) compensates for falling volume (-3.0%)

The latest Plumbing & Heating Merchant Index (PHMI) report, published in August, shows total value sales through specialist Plumbing & Heating merchants were up +3.9% in Q2 2023 compared to the same period in 2022.

With no difference in trading days, growth was driven by higher prices (+7.2%) as volumes fell -3.0%.

Quarter-on-quarter, Q2 2023 sales were -12.0% behind Q1 2023. Volume sales were -8.9% lower and prices also fell -3.4%. The drop in value sales wasn’t helped by four less trading days in the most recent quarter. Like-for-like sales, which take these trading day differences into account, were -6.1% lower in Q2.

Total value sales through specialist Plumbing & Heating merchants for July 2022 to June 2023 were +8.4% higher than the same 12 months the previous year. Prices increased +9.1% while volume edged lower (-0.7%). With one less trading day in the most recent period, like-for-like sales were +8.8% higher.

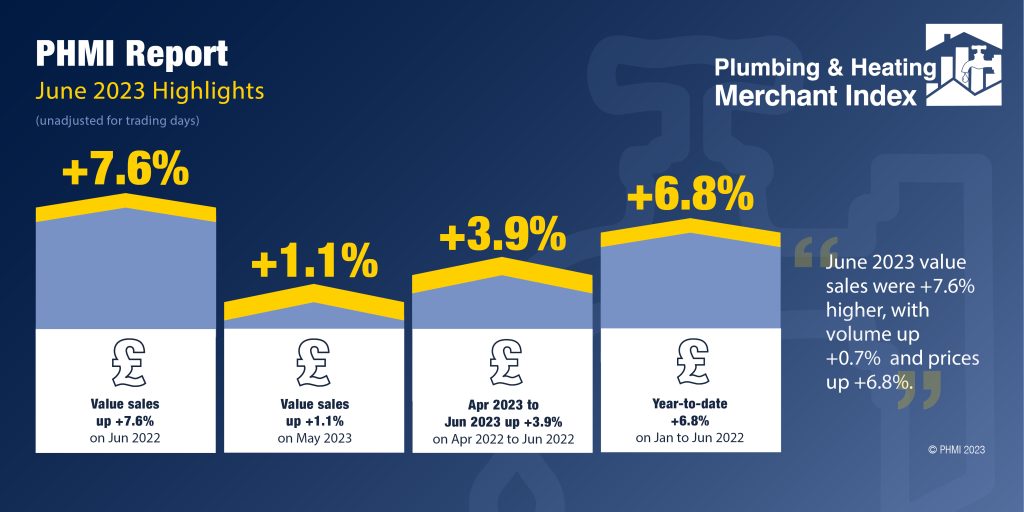

June 2023 value sales were +7.6% up on the same month a year ago, helped by two additional trading days this year. Volumes increased marginally (+0.7%) and prices were also higher (+6.8%). Like-for-like sales were -2.2% lower year-on-year.

Month-on-month, June value sales were slightly ahead (+1.1%) of May. Volume sales were +2.1% higher and prices eased -1.0%. With two additional trading days in June, like-for-like sales were -8.1% lower.

The PHMI Index for June 2023 was 98.8. With one more trading day compared to the base period, the like-for-like sales index was 92.8.

Mike Rigby, CEO of MRA Research, which produces the report comments: “This year has been tough for plumbing and heating merchants and the latest PHMI figures show that price inflation – not an increase in volumes – is the driving factor.

“But there could be a turning point ahead. Inflation is easing, energy costs are gradually coming down (the EPG went down again in July) and even mortgage rates are looking more attractive as lenders compete to draw in new customers. Consumer confidence has improved significantly since the lows of September 2022, according to GfK’s Consumer Confidence Index. But for a -6 drop in confidence in July it’s been a steady enough improvement this year. All eyes will be on August’s index!

“We’re also seeing a return to modest growth for UK construction output after three months in decline. While private housebuilding and repair, maintenance and improvement activity remains subdued, the ingredients are there for a modest pick up, particularly as we head into the traditional ‘heating season’ in Q3.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research. There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.

To download the latest report visit www.phmi.co.uk.