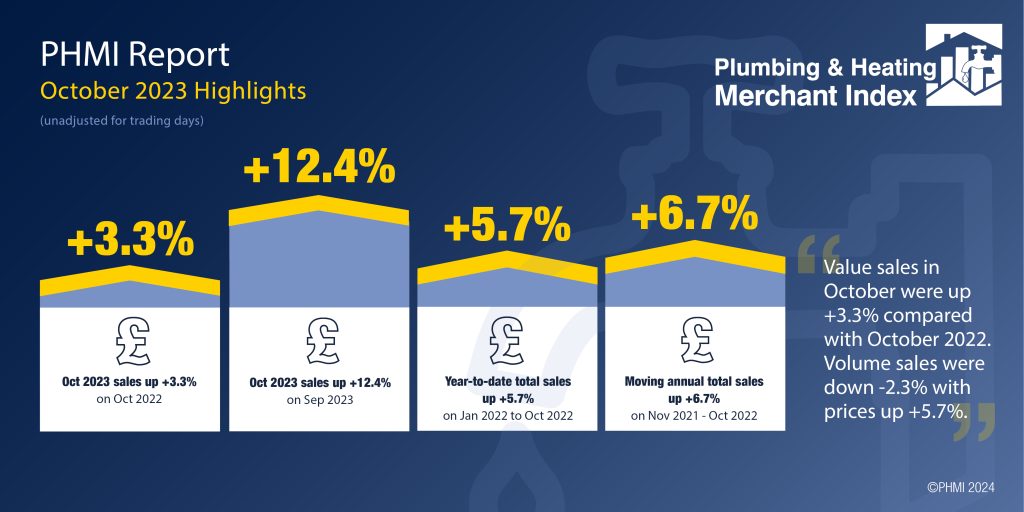

P & H Merchants’ October value sales up 3.3% year on year but volumes down

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for October 2023 through specialist plumbing and heating merchants were up +3.3% in 2023 compared to the same month in 2022. However, it was price (+5.7%) and not volume (-2.3%) driving growth. With one more trading day in October 2023, like-for-like sales were down -1.4%.

Compared to September, October value sales were up +12.4%. Volume sales recorded a +9.0% increase month-on-month, while prices edged up +3.1%. Like-for-like sales, taking into account the extra trading day in October, were up +7.3%.

Total value sales over the last three months, August to October 2023, were +1.5% higher than the same period a year ago. Volume sales were down -4.2% while prices rose +6.0%. With one more trading day in the most recent three-month period, like-for-like sales were flat.

Comparing August to October with the previous three-month period, value sales were +6.9% higher than May to July 2023. Volumes grew (+2.7%) as did price (+4.1%). Like-for-like value sales were up +3.7%.

Plumbing & Heating merchants’ value sales in the 12-month period from November 2022 to October 2023 were +6.7% higher than the previous twelve-month period. But volumes were down -1.4% and prices increased +8.2%. With one more trading day in the most recent period, like-for-like sales were +6.2% higher.

October’s PHMI index was 114.1. With an additional trading day compared to the base figure, the like-for-like index was 107.2.

Mike Rigby, CEO of MRA Research, which produces the report says: “While there was a +9.0% seasonal lift in October’s volume sales compared to September, volumes were still down -2.3% year on year.

“With UK construction output in decline (construction output decreased -0.3% in the three months to October 2023) and housebuilding in the doldrums, an autumn of heavy rainfall and strong winds further hampered housebuilding, so seasonal volume growth for plumbing and heating trades came predominantly from the repair, maintenance and improvement market. ONS data suggests the RMI market increased +1.3% in October.

“An increase in energy prices as the energy price cap goes up could dampen spirits in 2024, but it’s an election year, and against a virtual flat economy, inflation is on its way down. GfK’s Consumer Confidence Index is now 20 points better than this time last year and all five key measures improved. Although December’s headline figure of -22 is still firmly negative, optimism for our personal finances for the next 12 months shows a strong recovery from the depressed -29 last December. Christmas spending and major retailers’ sales, such as Tesco’s, were far better than forecasters expected. Despite the cost-of-living crisis restricting many households, these are encouraging signs for the year to come.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.