P&H Merchants’ August value sales down -2.6% year-on-year as volumes fall -9.2%

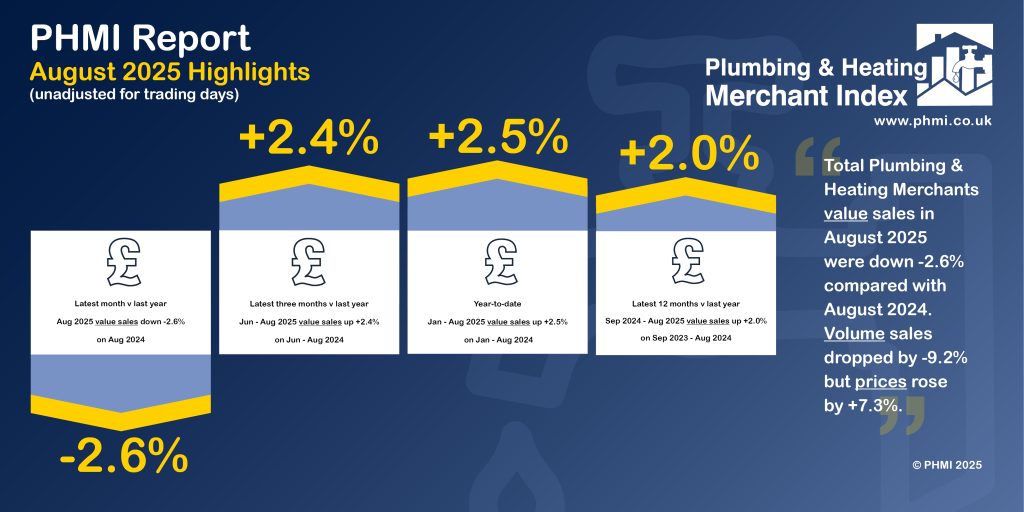

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for August 2025 through specialist plumbing and heating merchants were down -2.6% compared to August 2024. Volume sales dropped -9.2% and prices increased +7.3% year-on-year. With one less trading day this year, like-for-like value sales (which take trading day differences into account) were up +2.3%.

Month-on-month, August value sales were -12.8% down compared to July. Volume sales decreased sharply (-15.0%), while prices were up +2.5%. With three less trading days in August, like-for-like value sales were up +0.2%.

Total value sales in the three-month period from June to August 2025 were +2.4% higher than the same period a year ago (June to August 2024). Volume sales were down -2.8% and prices increased +5.3%. There was no difference in trading days.

Value sales in the three months from June to August 2025 decreased -5.5% compared to the previous three-month period, March to May 2025. Volume sales were -2.6% lower, and prices were down -2.9%. With three extra trading days in the most recent period, like-for-like value sales were -9.9% lower.

Year-to-date value sales for January to August 2025 were up +2.5% compared to the first eight months of 2024.

Plumbing & Heating merchants’ value sales in the 12-month period from September 2024 to August 2025 increased +2.0% compared to the previous 12-month period (September 2023 to August 2024). Volume sales were up +1.8%, and prices inched up +0.2%. With one less trading day in the most recent period, like-for-like value sales were +2.4% higher.

August’s PHMI index was 90.4. With one less trading day compared to the Index base period, the like-for-like value sales index was 93.4.

Mike Rigby, Managing Director of MRA Research which produces the BMBI report says: “August’s PHMI report showed that August was an extra quiet month for Britain’s plumbing & heating merchants and their trade customers. How much of the drop in volumes can be blamed on the weather and how much on hesitancy among consumers and businesses as economic prospects looks uncertain is anyone’s guess. But 2025 has pushed the famous summer of 1976 out of the UK top five hottest summers on record. An August heatwave brought temperatures of 33.4C in parts of England. The weather was variable and varied by region with hosepipe bans across large parts of England, while Storm Floris brought gusts of over 80mph to parts of the UK and widespread disruption in Scotland.

“The latest housing statistics suggest that housing starts are up 2% quarter-on-quarter, and 16% year-on-year in quarter 2 2025, but other housing indicators are tracking down. Turning around the slump in housing would lift spirits in specialist plumbing and heating merchants, but it may be some time before planning reforms and programmes to upskill the workforce to deliver more homes bear fruit.

“Consumer confidence was down two points to -19 in September, according to GfK’s Consumer Confidence Index. Its major purchase index – a barometer for RMI project intentions – was down three points. There’s been no let-up in the squeeze on stretched household budgets, but consumers are more positive for their own prospects in the next twelve months than they are for the economy. But the prospect of tax rises in the upcoming Autumn budget is weighing heavily on homeowners and businesses alike, causing them to pause before they spend.

“There is the prospect of better news for plumbing & heating merchants, in a pre-budget announcement that Rachel Reeves is expected to unveil a raft of planning changes to make it easier for developers to press ahead with housebuilding and infrastructure projects. But the Government may need to do more to lift consumer and business confidence.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from NIQ GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.