P&H Merchants’ Q3 value sales up +2.8% year-on-year

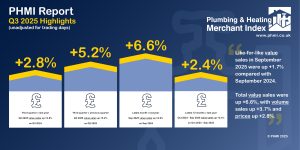

The latest Plumbing & Heating Merchant Index (PHMI) report, published in December, shows Q3 2025 total value sales through specialist Plumbing & Heating merchants were up +2.8% compared to Q3 2024. Volumes sales were down -2.5% while prices increased +5.4%. There was no difference in trading days.

Total value Q3 sales were +5.2% higher quarter-on-quarter, but with four more trading days than Q2, like-for-like value sales for July to September 2025 were -1.3% lower than the previous quarter (April to June 2025). Total volume sales were up +3.5% and prices increased +1.7%.

September’s like-for-like value sales were up +1.7% year-on-year, as September 2025 had one more trading day compared to the same month the previous year. Volumes were up +3.7%, as were prices (+2.8%). Total value sales without trading day adjustment were +6.6% higher year-on-year.

Month-on-month, September like-for-like value sales increased +9.6% compared to August, with two more trading days in September. Volume sales lifted +17.8% and prices increased +2.4%. Unadjusted for trading days, month-on-month value sales were +20.6% up.

Year-to-date, January to September 2025, like-for-like value sales for were +3.5% up on the first nine months in 2024, with one less trading day than the first nine months of 2024. Total value sales for the year-to-date were +3.0% up.

Total value sales for the 12 months October 2024-September 2025 were +2.4% ahead of the same 12-month period the year before. Volume sales rose +1.6%, and prices increased +0.7%. There was no difference in trading days.

The like-for-like PHMI Index for September 2025 was 102.4, with one additional trading day compared to the base period. Setting aside trading day differences, the Index was 109.0.

Mike Rigby, Managing Director of MRA Research which produces the BMBI report says: “September sales were a relieving boost for specialist heating and plumbing merchants with a significant lift in value and volumes compared to August, ending the quarter on a positive note.

“The autumn is traditionally the start of the heating season, but normal trading patterns seem less certain these days, so the improvement in September provides some reassurance that customers are still investing in their homes – even when the economic outlook looks uncertain.

“A late budget and a stream of confusing briefings, leaks and about-turns from the Treasury and negative talk from Westminster have sent worrying signals to construction, other industries and nervous Labour MPs.

“The latest GfK Consumer Confidence index for November came in at -19, down two points from October, as public sentiment wilted ahead of the Budget, and households braced for possible bad news. All measures were lower. Expectations for personal finances shed two points to 1, while the outlook for the economy lost two points, at -32. The major purchase index slid three points at -15 too, as nervous shoppers put off big ticket spending. A fall across all five measures, says GfK, suggests the public is bracing for difficult news, with little in the current climate to lift expectations.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from NIQ GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.