MRA’s Research Roundup – December 2025

As 2025 wraps up, MRA Research reviews the latest data and recent developments in the construction sector to help make sense of what 2026 may bring.

A deflated third quarter

Figures covering the third quarter of 2025 have been looking quite pessimistic. For example, the Q3 figures from the Mineral Products Association (MPA) revealed continued weakness in aggregates, concrete and asphalt sales and the MPA said construction materials demand is at ‘crisis levels’.

Data from the Builders Merchants Building Index showed that merchants’ value sales in Q3 were down -0.1% and in the Construction Products Association’s Autumn Forecasts, growth expectations for construction output were revised substantially down on the previous forecast, to 1.1% in 2025.

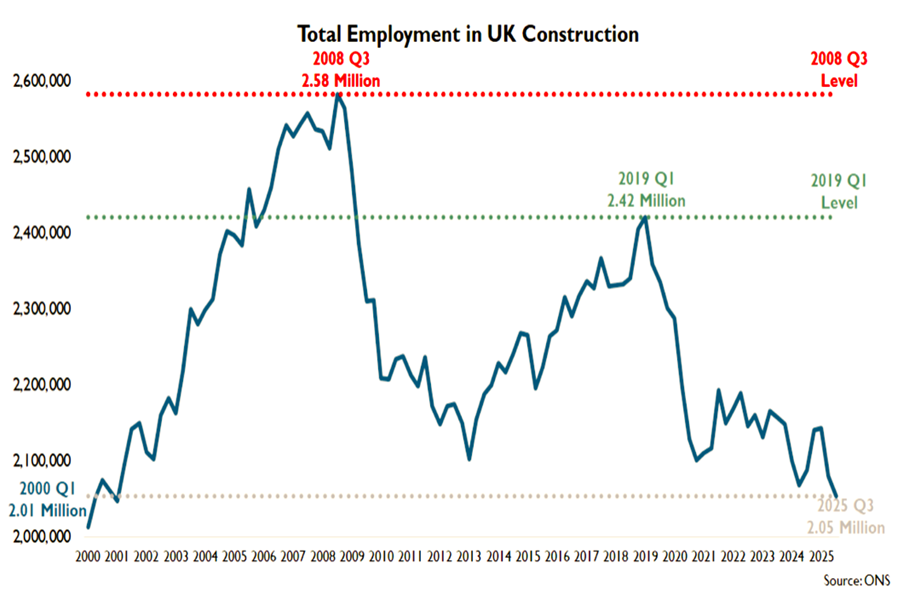

There was more bad news as the government released figures that showed that construction employment has sunk to a 24-year low, reaching its lowest level since 2000 and total site employment looks set to drop below two million.

The government then said there were issues with the Labour Force Survey model and that the data could not necessarily be trusted! But, research by the Centre for Social Justice (CSJ), released around the same time, said the construction workforce has fallen to its lowest proportion of total UK employment in over 100 years, which can’t be good news.

Some hope was provided in figures released by the National House Building Council in November, which showed new home registrations to be up for the third consecutive quarter. The data showed total new home registrations were up 8% in Q3 compared with Q3 2024. The rental and affordable sector saw a 6% uplift in the same period. Registrations were up for all house types with the exception of bungalows, which were down 9% in Q3 2025.

A budget of missed opportunity

Businesses across the whole country were eagerly awaiting, or in some cases dreading, the delayed budget announcement. Hopes were high, but expectations were low, with significant tax rises widely anticipated. In the end, the autumn budget turned out to be a storm in a teacup.

Having to wait for the budget caused a lot of uncertainty, having a negative impact on confidence within the construction industry. Stability is very important for confidence, and confidence is important for investment and construction activity.

MRA Reports ‘Pulse’, a survey of UK builders’ merchants’ expectations and confidence, found that the wait for the budget announcement was a big contributor to uncertainty in the market. Overall, merchants’ confidence in the market was poor in Q3, with only 21% of merchants more confident in the market this year than they were last year – and the top reason for being more confident is believing it can’t get any worse! Low expectation from the autumn budget was a key reason for the low market confidence.

At least we now know, even if the outcome did not provide any significant uplift in confidence. In general, it does not seem to have affected the market negatively either.

The BMF (Builders Merchants Federation) were not unhappy as such with the Budget, but their CEO John Newcomb said it delivers small incremental measures, when what the sector needs is a jumpstart, and that the Budget has “not done enough to bridge the gulf between the Government’s ambition to build 1.5 million new homes by July 2029 and the state of today’s market”. The BMF did welcome the moves to create developments around train stations and other transport hubs, and the announcement on Landfill Tax.

Noble Francis, Economics Director at the CPA summed it up; “Overall, it was a very disappointing Autumn Budget; disappointing for trust in government, for certainty, for working households, homeowners, businesses, clients and investors”. He also said the CPA expects to have to revise down its 2026 and 2027 forecasts further as a result.

In general, the Chancellor’s commitment to apprenticeships is being widely praised, with plans to make under-25 apprenticeship training free and financial allocations of £820m. The £13bn of flexible funding going to seven mayors across England is also a positive. There is also much anticipation for the Warm Homes Plan, which should go some way towards replacing the ECO, which ends in 2026.

However, there is concern about the National Living Wage and the resulting increase in the cost of doing business, which will end up being passed on to customers.

But let’s pause for a moment and reflect – has there ever been a budget that construction businesses were happy with? We can’t remember one. There is always something to complain about, and of course, it is in businesses’ interest to complain about the budget.

Having researched it, it turns out that the 1997 budget was actually ‘broadly welcomed by business’ as it supported SME growth. More recently, the mid-pandemic 2021 budget was also popular with construction firms, due to the introduction of a ‘super deduction’ measure providing tax relief on investment in plant and machinery and the announcement of new Freeports with enhanced tax relief. However, this budget mainly helped large developers so wasn’t universally popular with the construction sector.

Issues in construction

The answer to the question about the biggest issues affecting the construction industry at any given time depends on who you ask.

MRA Reports asked the question as part of their Pulse survey of builders’ merchants’ expectations and confidence. The biggest problems experienced by merchants in Q3 were squeezed margins, online competition and supplier price rises. They were seen as a problem for more than 1 in 2 merchants.

The survey also found that the majority of merchant branch managers expect to see flat or declining sales in Q4 2025 compared with Q4 last year.

Another recent survey, commissioned by SafeSite Facilities, asked a similar question of 500 construction industry professionals. In total, 27% of respondents saw rising material costs as the number one problem faced by the industry. This was followed by poor site safety standards at 23% and environmental sustainability pressures at 22%. Skills- and labour shortages also came high on the list.

In early December, the Builders Merchants Federation published the results of its third annual State of Sustainability report. The report revealed that sustainability is gaining traction and highlights the need for greater customer engagement to maintain progress.

The proportion of merchants reporting that they stock products with EPDs had doubled over the past year, rising to 60% of respondents. Awareness has also improved, the number of merchants unsure whether their products carry sustainability credentials fell substantially in 2024/25.

There is no doubt that awareness, and the importance of being on top of, sustainability will be a key issue in 2026.

A flat finish

Overall, it is likely that many firms in construction will be glad to see the back of 2025. Most market sectors within construction look set to record flat growth, at best, as the year draws to a close.

The November Construction PMI, a survey based index of construction activity, indicated that we are seeing the steepest downturn in construction output in the UK for five-and-a-half years. All three construction sub-sectors have seen their greatest falls in activity since May 2020, with steep reductions in new orders and employment. And business optimism was the weakest since December 2022.

Things can only get better.

We did eventually have some positive news on construction towards the end of Q4 (although some of it read like Government PR…).

There were further details on the mayoral funding package that was announced as part of the budget and means six regions will receive up to £200m per year over the next 30 years to build new homes, regenerate high streets and transform communities, under the Devolution Priority Programme.

Homes England announced that its infrastructure grant, worth £23m, had been awarded to Transport for London (TfL) to add public transport links as part of the development of two brownfield sites in London. It also announced a partnership with Swiss Life Asset Managers and Capital&Centric to build a further 2,250 homes across England.

On the topic of housing, even the Housing Secretary, Steve Reed, admitted there would need to be a sharp surge in order meet the target of building 1.5 million new homes. He said in a Radio 4 interview that he was hopeful about the impact of the planning reforms in particular, with the Planning and Infrastructure Bill expected to “dramatically speed up” decision making.

The Office for Budget Responsibility (OBR), predicts that the supply of new housing is due to hit a low of 215,000 next year, but to start rising sharply in 2029-30.

We may have to wait a couple of years for a boost in construction activity. But there are some product areas and companies that are growing or performing well, even in the current climate. It is a good opportunity take a look at one’s own business or ask one’s customers what their plans are – or even compare the two.

Get in touch to find out more about MRA Research’s services in 2026.