Builders’ Merchants’ sales resilient in third lockdown

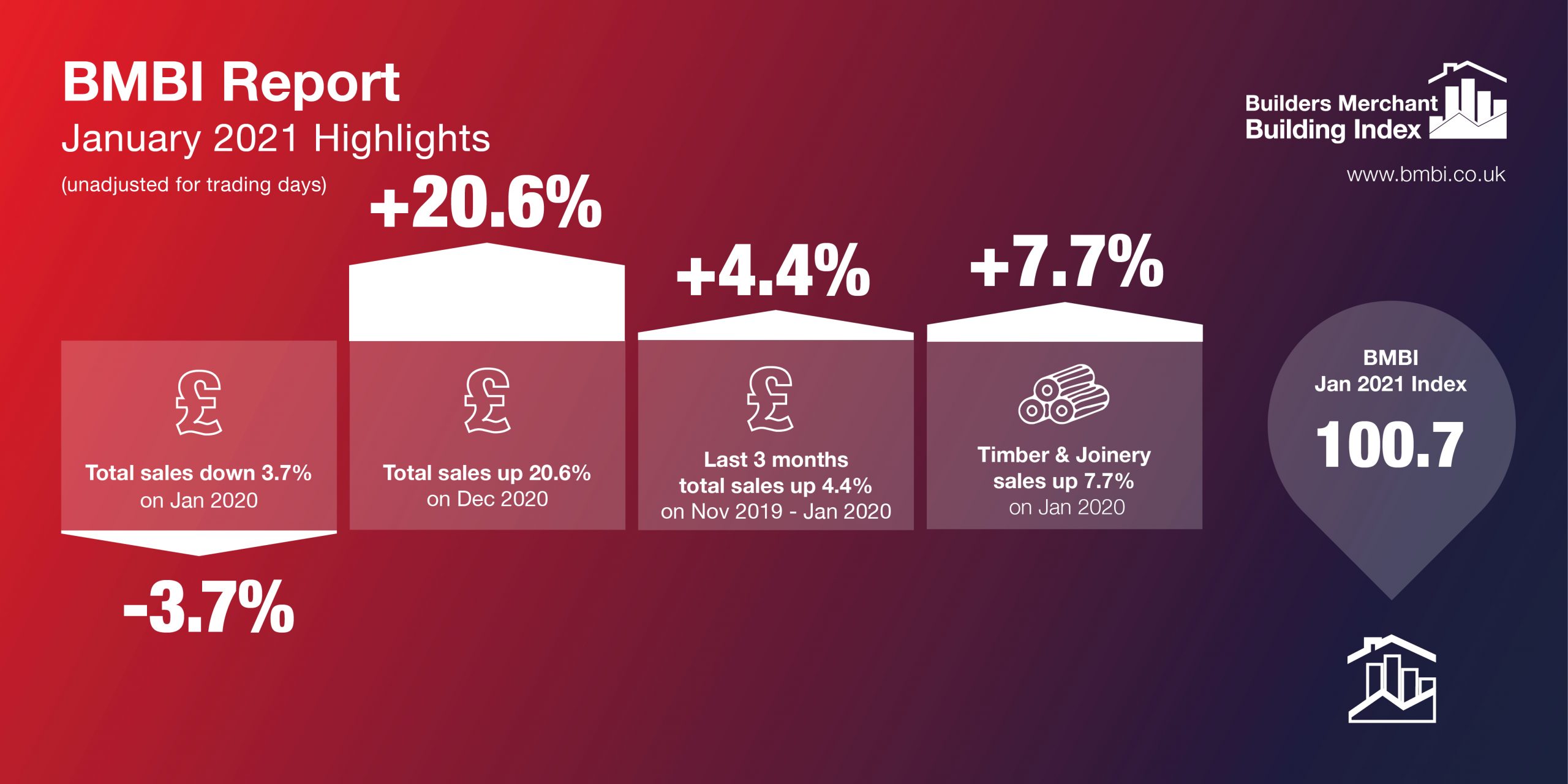

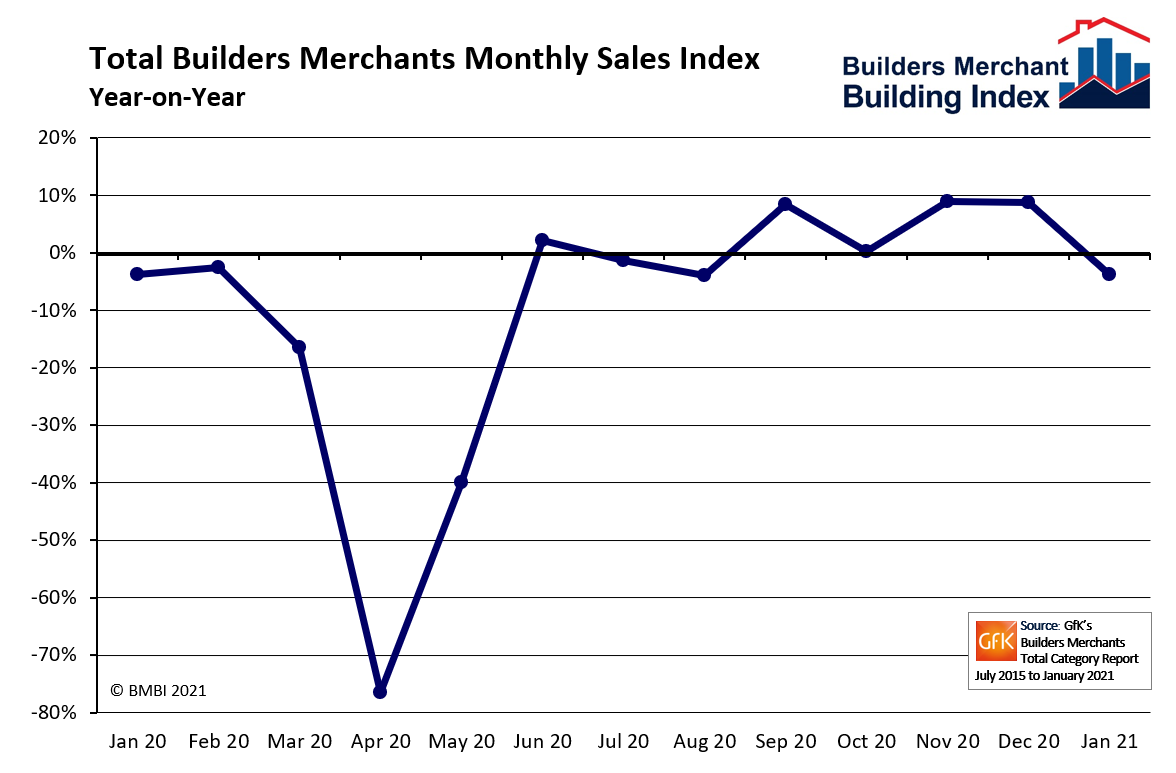

The latest Builders Merchants Building Index (BMBI) report shows that value sales in January by Britain’s builders’ merchants were 3.7% lower than in January 2020, as the country went into lockdown for the third time. However, there was a two day difference in trading days, and on an adjusted basis, total sales were 5.9% higher.

Year-on-year growth was driven primarily by three product categories. The largest contribution was made by Timber & Joinery Products, for which sales were up 7.7% on January 2020, while Landscaping (+3.7%) and Workwear & Safetywear (+2.4%) sales were also above last January’s level.

In contrast, indoor trades appear to have been negatively affected by the return to lockdown. Both the Plumbing Heating & Electrical and Kitchens & Bathrooms categories saw double-digit falls, with Decorating the weakest category at 17.2% below last years’ level.

Sales in the three months to January 2021, for which there was no difference in trading days, were 4.4% higher than in the three-month period to January 2020. Once again, Timber & Joinery Products and Landscaping were the top performing categories.

Compared with the previous month, total January 2021 sales were 20.6% higher, helped by three more trading days. Workwear & Safetywear (+39.1%) did best, with Timber & Joinery Products and Heavy Building Materials also performing well.

Mike Rigby, CEO of MRA Research, which produces the BMBI reports says: “Given the post-Brexit shipping delays, various supply problems related to the pandemic and a third lockdown being imposed in January, these figures actually paint a positive picture and show it’s been pretty much business as usual for merchants, despite the many challenges they have faced.

“As we approach the first anniversary of the initial lockdown, it is interesting to look at merchants’ sales over the 12 months to January 2021, which bear the full impact of Covid-19 closures in the Spring. While total sales are only 10.8% lower than in the previous 12 months, it is concerning that indoor trades have seen a much slower pace of recovery than other sectors.

“The Kitchens & Bathrooms and Plumbing, Heating & Electrical categories are almost 20% below last year’s level, as showrooms have been closed and householders have been reluctant to undertake bigger projects such as replacing bathrooms, kitchens or boilers while being stuck at home.

“In the Landscaping category, on the other hand, sales have already recovered and are 5.7% higher over the 12 months. And with travel expected to be limited until the summer at least, the sector could be set for another record Spring.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

January’s BMBI report is available to download at www.bmbi.co.uk.