Plumbing & Heating Merchants Q2 value sales slip -1.8% v Q2 2023.

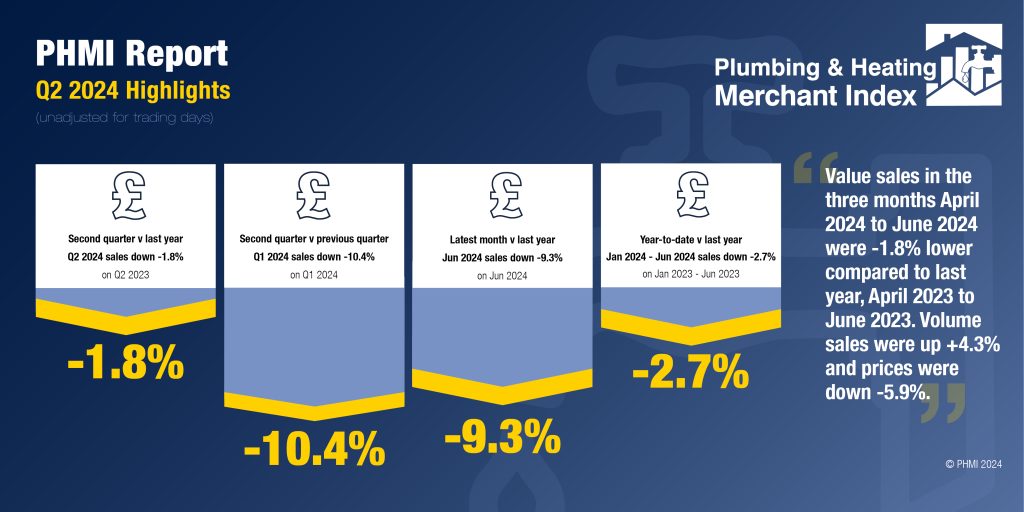

The latest Plumbing & Heating Merchant Index (PHMI) report, published in August, shows Q2 2024 total value sales through specialist Plumbing & Heating merchants were -1.8% lower than in Q2 2023. Volumes sales were up +4.3% but prices fell -5.9%. With two more trading days this year, like-for-like sales were down -5.0%.

Quarter-on-quarter, total value sales for April to June 2024 dropped -10.4% compared to January to March 2024. Volume sales were +1.4% higher with prices -11.7% lower. With one less trading day in Q2, like-for-like sales were -9.0% lower.

The Q2 performance was impacted by June sales, down -9.3% against the same month in 2023. Volumes slipped -6.3% and prices also decreased -3.2%. With two less trading days in June 2024, like-for-like sales were flat (-0.2%).

Month-on-month, June value sales were down -6.3% compared to May. Volume sales fell -9.4% and prices were up +3.3%. With one less trading day in the most recent period, like-for-like sales were -1.7% lower.

Year-to-date value sales in the first six months of 2024 were down -2.7% compared to the first six months of 2023, with volumes down -1.2% and prices down -1.5%.

Total value sales through specialist Plumbing & Heating merchants for the 12-month period July 2023 to June 2024 were slightly lower (-0.5%) than the same period a year before (July 2022 to June 2023). Volume sales were down -2.4% and prices increased +2.0%. With an additional two trading days in the most recent 12-month period, like-for-like sales were -1.3% lower.

The PHMI Index for June 2024 was 90.0. With one less trading day compared to the base period, the like-for-like sales index is adjusted to 93.0.

Mike Rigby, CEO of MRA Research, which produces the report comments: “With a newly elected government in charge, and one which is pledging to build 1.5 million homes over the next five years, there is an air of optimism in the industry, not yet reflected in Plumbing & Heating merchants’ sales to the trade. But much as it wants to build those homes and make the UK’s existing housing stock of around 30 million dwellings fit for the future, the industry is questioning its capacity to do so.

“The UK construction workforce fell again in 2024 Q2, according to the latest ONS data, reports Noble Francis, Economics Director of the CPA. In 2024 Q2, there were 2.04 million workers in construction, he says, 5.1% lower than a year ago, its lowest level since 2000 Q1. It was also 15.9% lower than 2019 Q1 and 21.0% lower than the peak in 2008 Q3, which was before the impacts of the financial crisis. The key losses have been in self-employment and in the old-age demographic. The workforce is likely to take a very long time to get back to 2019 Q1 levels.

“The limiting factor in both housebuilding and the RMI of the existing housing stock is the growing skills shortage. According to the Federation of Master Builders (FMB) Q2 2024 State of Trade Survey the UK is currently experiencing a construction skills crisis, with a high proportion of tradespeople within 10 years of retirement. The FMB reports a net +7% increase in total workloads this quarter. But 43% of FMB members reported a shortage of skilled tradespeople resulting in project delays, up from 36% in Q1.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.