Plumbing & Heating Merchants Q3 value sales were flat year-on-year, but volume increased +5.3%.

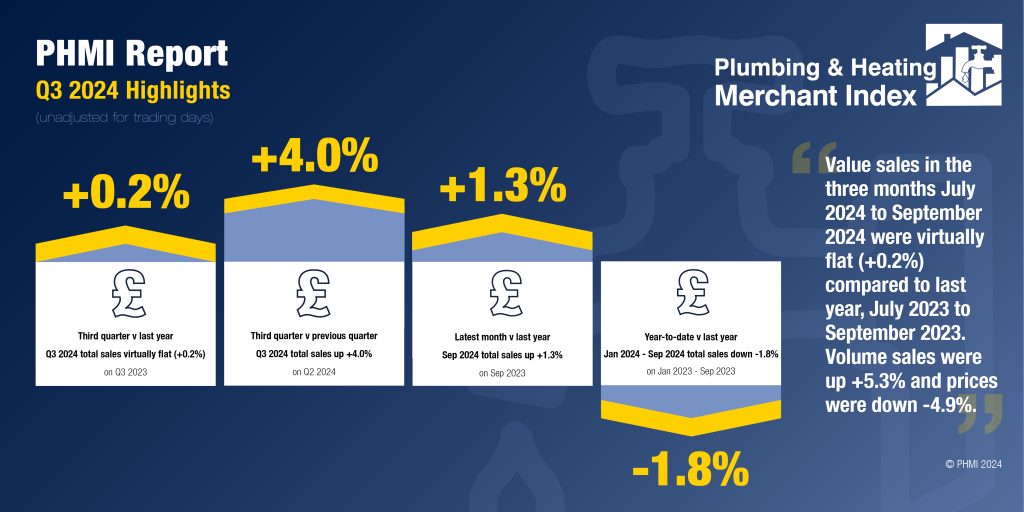

The latest Plumbing & Heating Merchant Index (PHMI) report, published in November, shows Q3 2024 total value sales through specialist Plumbing & Heating merchants were virtually flat (+0.2%) compared to Q3 2023. Volumes sales increased +5.3% but prices fell -4.9%. With one more trading day this year, like-for-like sales were -1.4% lower.

Quarter-on-quarter, total value sales for July to September 2024 were +4.0% higher than the previous three-month period, April to June 2024. Volume sales were up +3.2% and prices also rose +0.8%. With three additional trading days in Q3, like-for-like sales were -0.8% lower.

Q3 sales were helped by September sales, up +1.3% compared to the same month in 2023. Volumes increased +4.6% and prices decreased -3.1%. There was no difference in trading days.

Month-on-month, September value sales were up +10.1% compared to August. Volume sales rose +3.1% while prices were +6.7% higher. There was no difference in trading days.

Year-to-date value sales in the first nine months of 2024 were down -1.8% compared to the same period January to September in 2023. Volume sales saw improved marginally (+0.9%) while prices slipped -2.7%.

Total value sales through specialist Plumbing & Heating merchants for the 12-month period October 2023 to September 2024 were -1.2% down compared to the same 12 months a year before (October 2022 to September 2023). Volume sales (-0.5%) and prices (-0.6%) were little changed. With three additional trading days in the most recent 12-month period, like-for-like sales were -2.4% lower.

The PHMI Index for September 2024 was 102.4.

Mike Rigby, MD of MRA Research, which produces the report comments: “Trading conditions haven’t been easy. Consumers are feeling the pinch, and confidence fell to -21 in October, according to GfK’s Consumer Confidence Index. That’s a lot better than September’s-30 but it’s a lot worse than August’s -13 when the public expected great things from the new government. Perhaps the most telling metric in GfK’s research was people’s sentiments about the general economic situation over the next 12 months. It fell a further -1 point to -28, a massive drop since August’s -13.

“Some people always do better than others in Chancellors’ Budgets. But many feel a lot worse off because of this Budget and retailers and the old are protesting the unfairness, while angry farmers are blocking Whitehall in their thousands. The Budget’s also getting a kicking from Paul Johnson, of the Institute of Fiscal Studies, that most neutral and respected commentator. Growth the promise, but growth it isn’t!

“But there’s good news in the pipeline for heating and plumbing. Plans to sort out planning and build 1.5 million homes; a three-year commitment to provide £3.4bn for the first steps of the government’s Warm Homes Plan; money for the Boiler Upgrade Scheme and a promise to boost the heat pump sector: what’s not to like? Now all the government needs to do is press the big green Go button to get growth going! Well not quite. We must all wait for the details and start dates.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, or learn more about becoming an Expert, speaking on behalf of your market, visit www.phmi.co.uk.