BMBI reports continued strong year-on-year growth

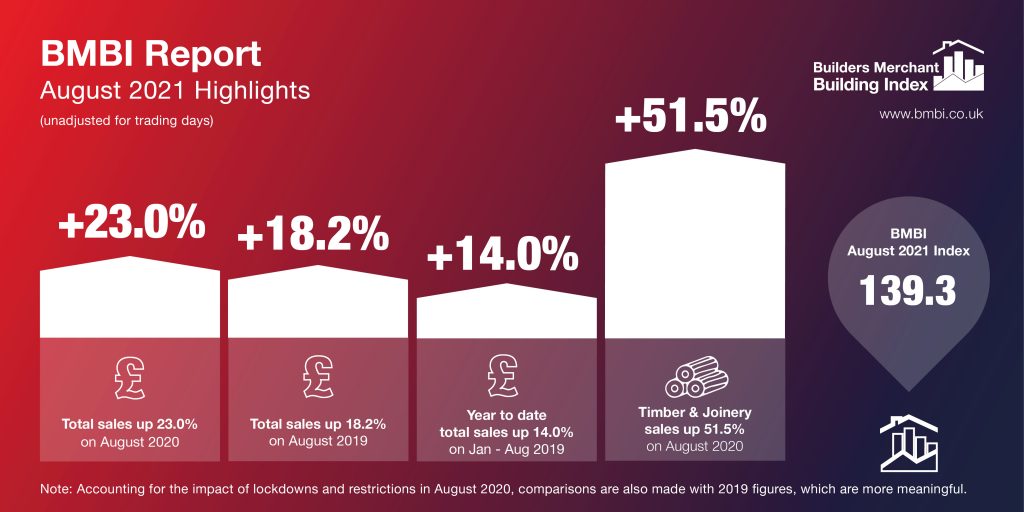

The Builders Merchant Building Index (BMBI) August report, published in October, reveals that builders’ merchants’ August value sales were 23.0% higher year-on-year, with Timber & Joinery products once again topping the list of best performing categories (+51.5%).

Helped by one more trading day this year, eleven out of the twelve categories sold more in August 2021 compared to August 2020. Heavy Building Materials (+16.9%), Landscaping (+11.5%) and Kitchens & Bathrooms (+11.3%) put in a strong monthly performance. Workwear & Safetywear (-2.7%) was the only category to sell less over the period. Average like-for-like daily sales in August 2021 were up 17.1% on the same month last year.

Compared to August 2019, a pre-pandemic year, total merchant value sales were up 18.2% in August 2021, with no difference in trading days. This growth was largely driven by two categories – Timber & Joinery (+48.4%) and Landscaping (+29.7%). Heavy Building Materials (+10.1%), Services (+9.7%) and Kitchens & Bathrooms (+2.9%) also recorded higher sales compared to the same month two years ago.

For the second month in a row, total merchant sales were down in August compared to July (-7.9%) with no difference in trading days. Only Workwear & Safetywear (+3.1%) sold more, while Plumbing, Heating & Electrical (-3.6%), Kitchens & Bathrooms (-6.5%), Heavy Building Materials (-7.2%) and Timber & Joinery Products (-8.6%) all sold less. Landscaping (-14.4%) was the weakest category month-on-month.

August’s BMBI index was 139.3, helped by strong performances from Timber & Joinery Products (182.6) and Landscaping (175.3). Seven other categories exceeded 100, including Heavy Building Materials (127.0), Ironmongery (120.2) and Kitchens & Bathrooms (118.3).

Mike Rigby, CEO of MRA Research who produces this report, said: “After a bumper year, sales began to ease over the summer. With all Covid restrictions removed in July, I expect a combination of exhausted people trying to grab a summer break and the continuing impact of material shortages and supply chain problems contributed to slowing sales. There are murmurs of material shortages easing but with no significant lessening of demand it will take time to shorten current long lead times for many products and solve the complicated supply chain problems.”

Mike Rigby, CEO of MRA Research who produces this report, said: “After a bumper year, sales began to ease over the summer. With all Covid restrictions removed in July, I expect a combination of exhausted people trying to grab a summer break and the continuing impact of material shortages and supply chain problems contributed to slowing sales. There are murmurs of material shortages easing but with no significant lessening of demand it will take time to shorten current long lead times for many products and solve the complicated supply chain problems.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK Retail & Technology UK adds:

“The exceptional growth seen against both 2019 and 2020 continues ahead, but we’re seeing the first stages of a pressurised market starting to ease off. Merchants have done well to manage supply chain challenges and continue to reap the rewards of this. Growth should continue to slow down in the coming months, especially with the stamp duty holiday coming to an end and some of the other wider UK economic challenges coming to the fore.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

Download the full report at www.bmbi.co.uk.