Steady Q4 sales round off modest growth year for Plumbing & Heating merchants

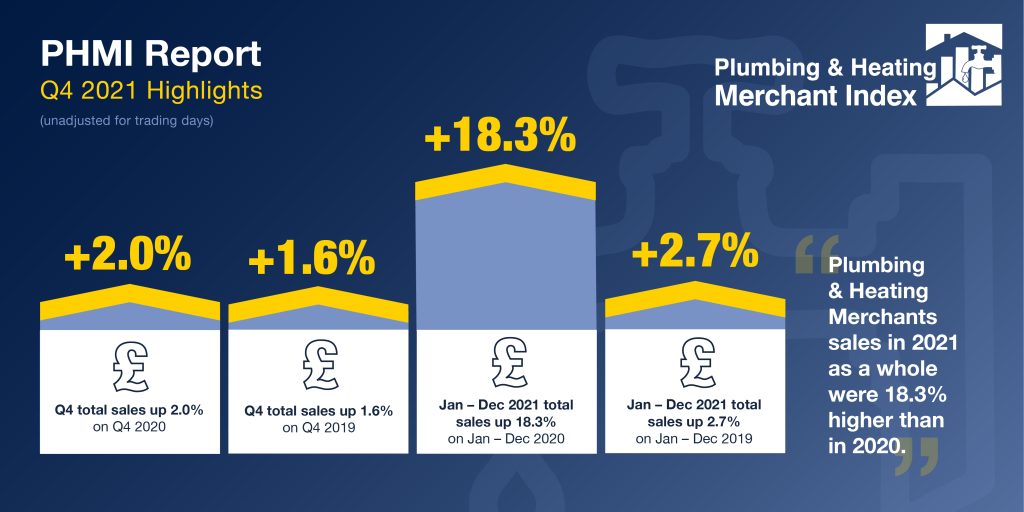

The latest Plumbing & Heating Merchant Index (PHMI) report, published in February, shows total value sales through specialist Plumbing & Heating merchants up 2.0% in Q4 2021 compared to the same period in 2020, with no difference in trading days.

When compared to the same period (October to December) in 2019, Q4 2021 recorded nominal growth, with value sales up 1.6% helped by two more trading days this year. Like-for-like sales were flat (-0.1%).

Quarter-on-quarter, Q4 2021 was 6.4% higher than Q3, with four less trading days in the most recent period. Like-for-like value sales were up 13.5%.

Thanks to another steady quarter, Plumbing & Heating Merchants sales for the full year 2021 were 18.3% higher than in Covid-affected January to December 2020, with two less trading days this year. Like-for-like sales were 19.3% higher. Compared to 2019, sales in 2021 were 2.7% higher, with no difference in trading days.

December 2021 was just 0.3% higher than December 2020 with an equal number of trading days. December 2021 compared more favourably to the same month in 2019 (+4.6%), helped by two extra trading days. Like-for-like sales were 7.7% lower.

Total value sales through specialist Plumbing & Heating merchants were 30.6% lower in December than in November 2021. This is broadly in line with seasonal trends and sales were also impacted by four less trading days. Like-for-like sales were 10.2% lower.

The PHMI Index for December 2021 was 84.1, with four less trading days this year. The Q4 PHMI Index was stronger at 105.5, with two less trading days.

Bill Davies, Sales Director at James Hargreaves Plumbing Depot, said: “We saw record sales in 2021; 24.5% up against 2020 and there are still plenty of reasons to feel optimistic for the current year. However, there are already clear signs that the effect of price increases within the plumbing/heating market are making things more challenging.

“We have seen record percentage price increases from numerous suppliers, some applying more than one, and surcharges that now seem to have become unofficial price increases. Couple these increases with the pressure of the general cost of living and it could lead to homeowners delaying projects.

“We have seen record percentage price increases from numerous suppliers, some applying more than one, and surcharges that now seem to have become unofficial price increases. Couple these increases with the pressure of the general cost of living and it could lead to homeowners delaying projects.

“To offset these price increases we are already seeing some customers looking for lesser branded products – searching for that price advantage.

“So while the market remains buoyant, the pressure on pricing and margins is the biggest challenge for 2022. It could be a tough year, but one that could still prove rewarding. Positivity and hard work very much among the key elements needed.”

Mike Rigby, CEO of MRA Research, which produces the report comments: “Quarter four PHMI figures for the market show that sales through specialist plumbing and heating merchants have continued to show momentum.

“As we move into 2022, demand from homeowners for more efficient heating and hot water systems to counteract rocketing energy costs will undoubtedly drive sales, although the squeeze on household budgets may reduce the appetite for other home improvement projects. A buoyant housebuilding forecast for 2022 though will surely keep merchants busy while the repair, maintenance and improvement picture becomes clearer.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 80% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research. There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.

To download the latest report visit www.phmi.co.uk.