Q1 value sales up but Plumbing & Heating merchants volumes down

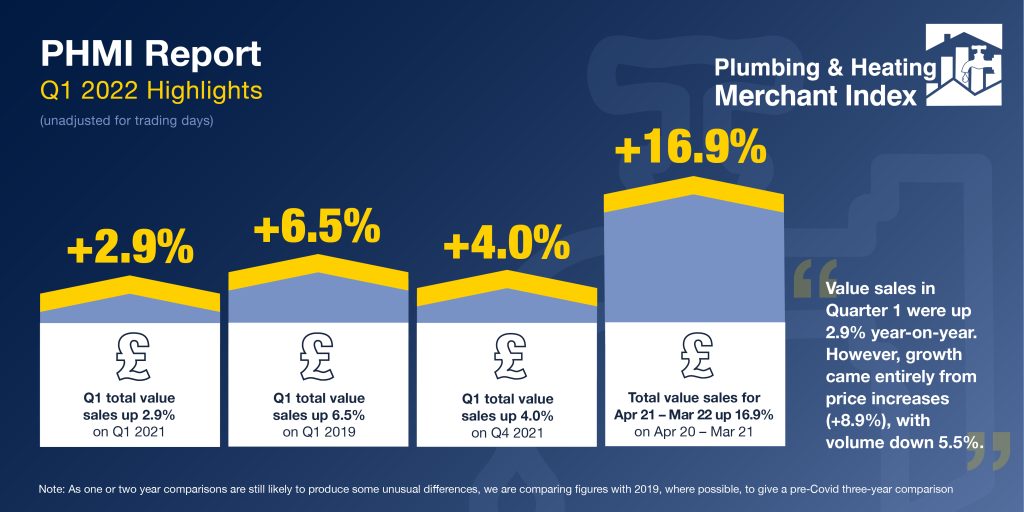

The latest Plumbing & Heating Merchant Index (PHMI) report, published in May, shows total value sales through specialist Plumbing & Heating merchants were up 2.9% in Q1 2022 compared to the same period in 2021, with no difference in trading days.

The increase in sales again came entirely from price inflation (+8.9%), while volumes were down 5.5%.

When compared to the same three-month period (January to March) in 2019, a pre-pandemic year, Q1 2022 value sales were up 6.5% with no difference in trading days.

Quarter-on-quarter, Q1 2022 sales were 4.0% higher than Q4 2021, with three more trading days in the most recent period. Like-for-like value sales were down 0.9%.

Plumbing & Heating Merchants sales in the 12 months to March 2022 were 16.9% ahead of April 2020 to March 2021, with one less trading day in the most recent period. Like-for-like-sales were up 17.4%.

March 2022 value sales were marginally ahead (+0.9%) of March 2021 with an equal number of trading days. This growth came from price inflation (+10.4%), not volume (-8.6%).

Compared to the same month three years ago, March 2022 sales were 14.7% higher than March 2019, helped by two more trading days this year. Like-for-like sales were up 4.7%.

Month-on-month, total value sales through specialist Plumbing & Heating merchants were 12.9% higher in March than in February, helped by three extra trading days in March. Like-for-like sales were down 1.8%.

The PHMI Index for March 2022 was 119.3, with two more trading days this year. The like-for-like index was 107.2.

Mike Rigby, CEO of MRA Research, which produces the report comments: “Q1 figures show that sales through specialist plumbing and heating merchants are still moving in the right direction, however growth is being led by price inflation rather than volumes, which are down year-on-year.

“The impact of inflation and rising costs looks set to be the focus for everyone this year – not just plumbing and heating merchants – and how this will affect sales for the rest of 2022 isn’t yet clear. On one hand, escalating energy costs and the prospect of more to come in the autumn will encourage some people to invest in home improvements which boost efficiency, while shrinking surplus income for other households will see projects and purchases being postponed.

“Much will depend on the return of consumer confidence, which has been further dented by the war in Ukraine, and the possibility of Government support for households who are struggling to meet energy costs.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 80% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research. There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.

To download the latest report, visit www.phmi.co.uk.