Builders’ Merchants’ sales to builders surge in September

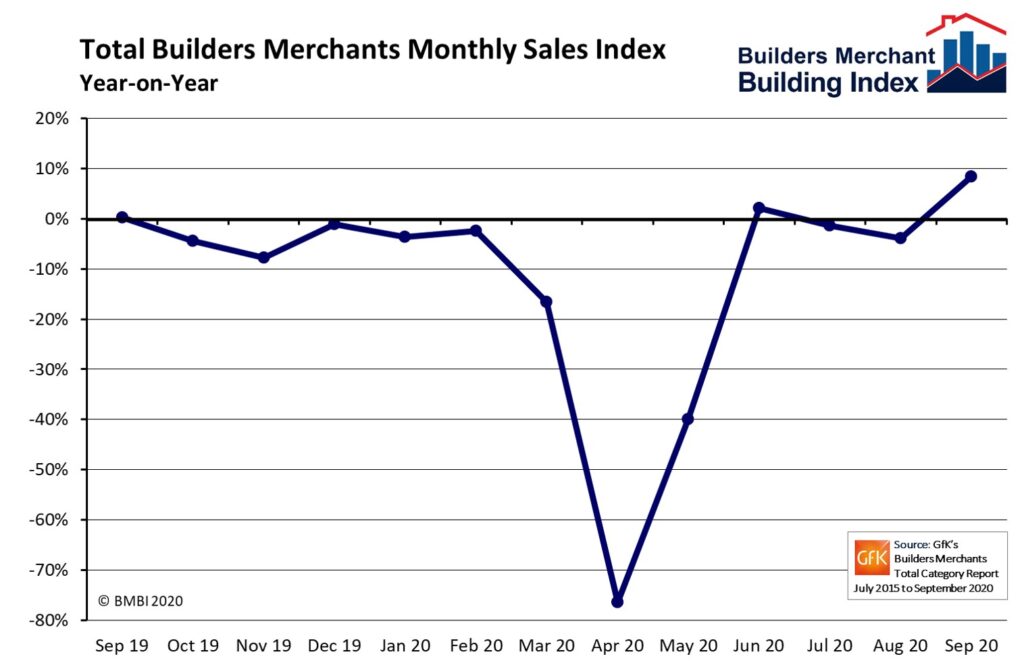

Sales to builders by Britain’s builders’ merchants surged in September, with sales up 8.3% compared with September 2019, according to the latest Builders Merchants Building Index (BMBI) report.

Sales to builders by Britain’s builders’ merchants surged in September, with sales up 8.3% compared with September 2019, according to the latest Builders Merchants Building Index (BMBI) report.

Q3 2020 sales also increased compared to the same period last year (+1%) and were significantly up on Q2 2020 (+63.2%) when many merchants were closed. Kitchens & Bathrooms saw the strongest quarter-on-quarter recovery (+131%), but Q3 sales were down 7.1% year-on-year.

Year-on-year, landscaping Q3 sales are 24.2% up, its highest level since the index was set up in 2015. Workwear & Safetywear, up 8% compared to Q3 last year, benefited from a continued focus on PPE, while Timber & Joinery was up 3.5% over the same period.

Although year-to-date sales were lower than in 2019 due to the impact of Covid-19 closures, overall sales had recovered strongly by September. The rate of recovery however, varied between product sectors. While two sectors – landscaping materials (+1.5%) and Workwear & Safetywear (+1.2%) – are ahead of January to September 2019, Kitchens & Bathrooms have some way to go, and Heavy Building Materials is 16.1% behind the same period last year.

Comments by the BMBI experts featured in the report indicate exceptionally high demand in some sectors during the quarter – particularly those associated with home improvements.

“The retail market had a bumper Q3 with masonry paint and woodcare sales rocketing,” says Paul Roughan Trade Merchant Sales Director, Dulux Trade. “However, demand massively outstripped supply as Britain continues to love decorating.”

“With a greater proportion of the UK population working from home than ever before,” explains Jim Blanthorne Managing Director Keylite Roof Windows, “the attention of many has turned to improving their homes to better serve the need for separate space for work and family life.”

“Q3 was so strong, from people staying at home and spending on their home rather than their holidays, that stock in key areas has been drained,” says Malcolm Gough, Group Sales & Marketing Director, Talasey Group.

Mike Rigby CEO of MRA Research, which produces the BMBI reports, says: “Key product sectors related to home and garden improvement have performed particularly strongly in Q3 indicating that people spending more money on their houses and gardens was not just a lockdown phenomenon but a trend that is here to stay.

“Homeowners have accepted that the ‘new normal’ will involve spending a lot more time at home for the foreseeable future, and they are adapting their homes for homeworking. Many also have more money to spend on getting someone in to do the work properly, benefiting builders’ merchants. Interestingly this trend is mirrored in America, where the giant Home Depot and Lowe’s have seen significant Q3 sales growth for similar reasons. With many people working remotely from home, DIY and paid-for home renovations are soaring as consumers spend on changing their homes to suit the way they live now.

“Merchants are expected to remain open for business throughout the second wave of Covid-19 with RMI work levels forecast to remain high,” Mike concludes.

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The data is actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders merchants throughout Great Britain.

August’s BMBI report is available to download at www.bmbi.co.uk.